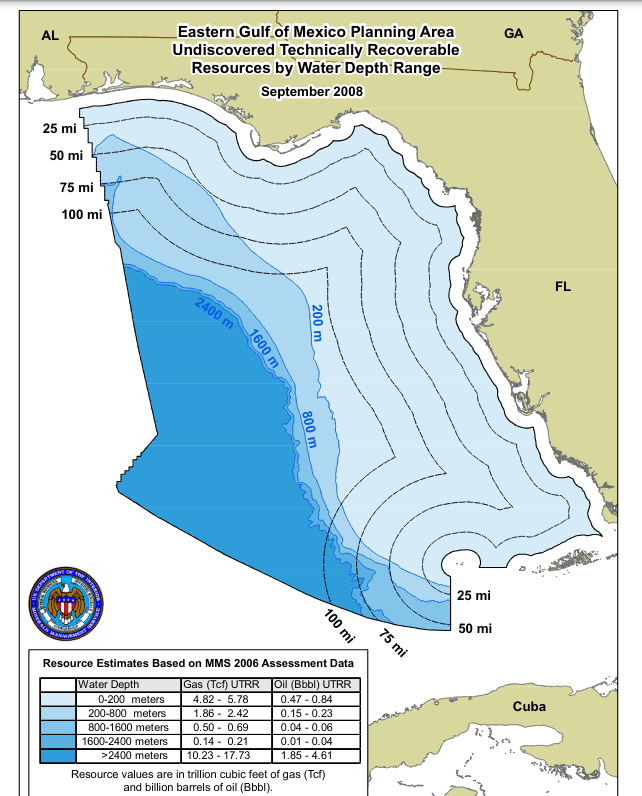

Will the oil and gas lease sale boldly named Big Beautiful Gulf 1 (BBG1) live up to its grand name? Given the more favorable lease terms and the 2 year gap since the last sale, BBG1 should surpass the previous 3 sales (table below). Questions:

- Which majors will be the most active bidders? Chevron? Shell? BP? Oxy/Anadarko?

- Will former Gulf of Mexico stalwarts Exxon and Conoco Phillips participate for the first time in years? Probably not, but US super-majors should participate in the US offshore program.

- How many companies will submit bids? Would like that to be a number >35.

- How many tracts will receive bids? A number >300 would be very encouraging.

- Will the total high bids exceed $400 million?

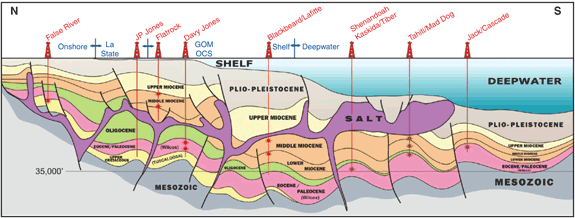

- Will we see an increase in shelf interest?

- Which independents will be the most active?

- After the not-so-clever carbon disposal acquisitions in the last 3 sales, will the number of carbon disposal bids be zero? For the first time ever, the Federal government felt compelled to stipulate the obvious (see the proposed notice for OCS Sale 262) – that an Oil and Gas Lease Sale is only for oil and gas exploration and development.

See the summary data below for the last 3 Gulf lease sales. We’ll fill in the blanks next week.

| Sale No. | 257 | 259 | 261 | BBG1 |

| date | 11/17/2021 | 3/29/2023 | 12/20/2023 | 12/10/2025 |

| companies participating | 33 | 32 | 26 | |

| total bids | 2233 | 2842 | 3161 | |

| tracts receiving bids | 2143 | 2442 | 2751 | |

| sum of all bids $millions | 198.5 | 309.8 | 441.9 | |

| sum of high bids ($millions) | 101.7 | 263.8 | 382.2 | |

| highest bid company block | $10,001,252.00 Anadarko AC 259 | $15,911,947 Chevron KC 96 | $25,500,085 Anadarko MC 389 | |

| most high bids company sum ($millions) | 46 bp 29.0 | 75 Chevron 108.0 | 65 Shell 69.0 | |

| sum of high bids ($millions) company | 47.1 Chevron | 108 Chevron | 88.3 Hess | |

| most high bids by independent | 14-DG Expl. | 13-Beacon 13-Red Willow | 22-Red Willow |