Add Dunkelflaute to the list of interesting and expressive compound German words. Die Dunkelflaute is a dark lull, a period of time in which minimal energy can be generated by the sun or wind. More specifically in German:

Die Dunkelflaute als sogenanntes Kofferwort beschreibt das gleichzeitige Auftreten von Dunkelheit und Windflaute. Diese Wetterlage entsteht typischerweise im Winter und sorgt für geringe Erträge aus Solar- und Windenergie bei gleichzeitig saisonal hohem Strombedarf. Eine Dunkelflaute kann mehrere Tage andauern. Kommen zu Dunkelheit und Windflaute noch niedrige Temperaturen hinzu, die für gewöhnlich den Strombedarf weiter ansteigen lassen, spricht man auch von “kalter Dunkelflaute.”

Note the prolonged Dunkelflaute (below) during which renewables provided minimal power in the middle of winter.

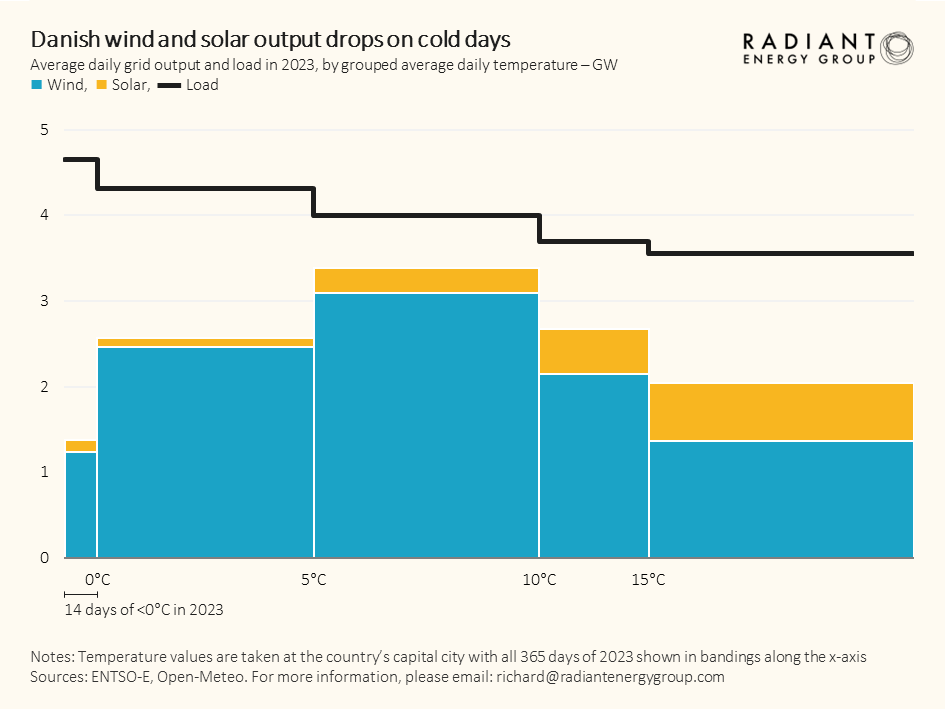

Unsurprisingly, wind and solar output are the lowest when the temperatures are the coldest. See the Danish summary for 2023 below. Note that wind output was also low when temperatures were above 15 deg. C.

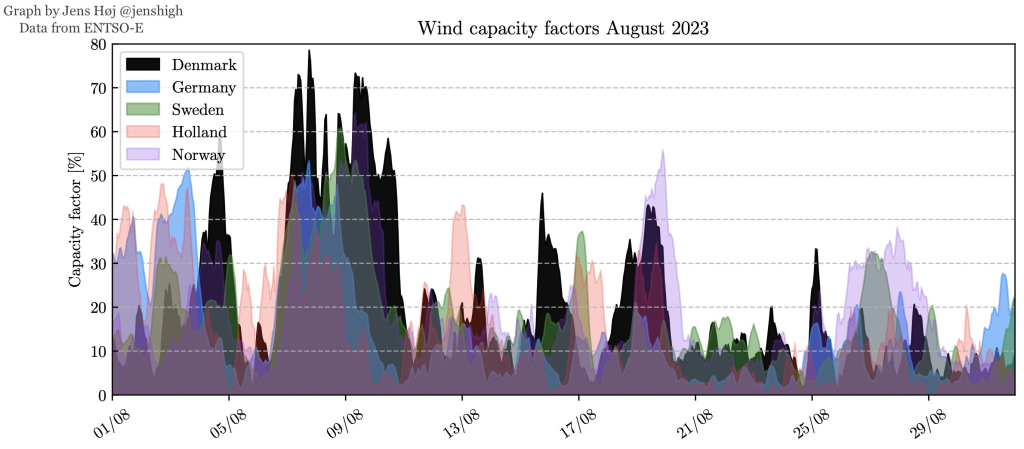

Regional wind energy grids are not always an effective solution as Danish physicist Jens Christiansen, a nuclear energy advocate, has illustrated:

‘The wind always blows somewhere.’ Is that really true though? Here I’ve looked at the capacity factors of wind from five northern European countries in August The winds seem highly correlated, and there is almost a week-long period without significant wind anywhere.

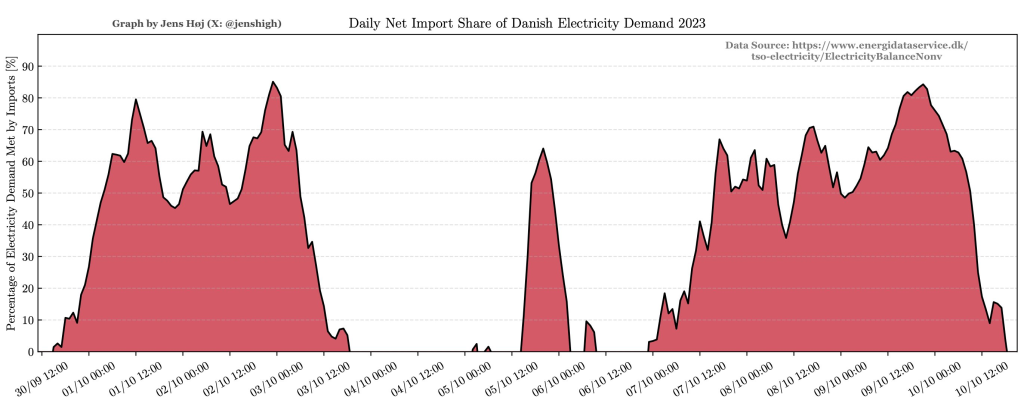

Christiansen illustrates Denmark’s reliance on imported electricity:

Paraphrasing Margaret Thatcher: “The problem with electricity imports is that you eventually run out of other people’s electricity.” In the U.S., California imports more electricity than any other state and typically receives between one-fifth and one-third of its electricity supply from outside of the state.

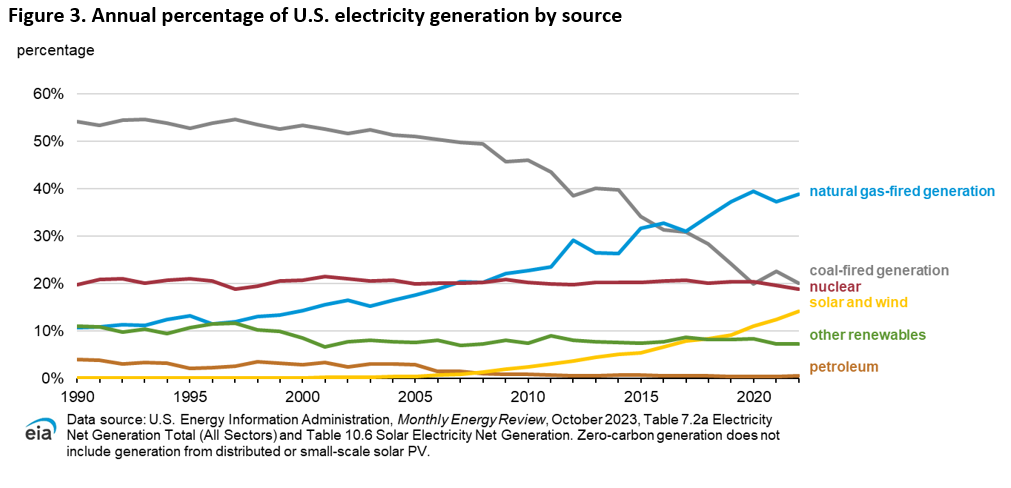

Given that massive battery storage is well beyond current capabilities and restrictions on electricity consumption and economic growth are undesirable, redundant or complementary power sources are essential for a reliable grid. Natural gas power generation is most responsive to variable demand, and is thus a good complement to variable sources like wind turbines and solar panels.