“Exxon Mobil has led a persistent and apparently successful lobbying campaign behind the scenes to push the US federal government to adopt rules that would allow the conversion of existing oil and gas leases in the Gulf of Mexico into offshore carbon capture and storage (CCS) acreage, according to documents seen by Energy Intelligence and numerous interviews with industry players.” Energy Intelligence

The Energy Intelligence article documents the ongoing carbon disposal lobbying by Exxon and others. Those meetings are okay prior to publishing a Notice of Proposed Rulemaking (NPRM) for public comment. However, the article implies that the next step is a final rule: “Whether or not Exxon succeeds will become fully clear when the US issues final rules guiding CCS leasing, expected sometime this year.”

A final rule this year is unlikely, because an NPRM has to be published first for public comment. The only exception would be if BOEM was able to establish “good cause” criteria for a direct final or interim final rule in accordance with the Administrative Procedures Act. Such an attempt at corner cutting seems unlikely, especially in an election year when all regulatory actions are subject to additional scrutiny.

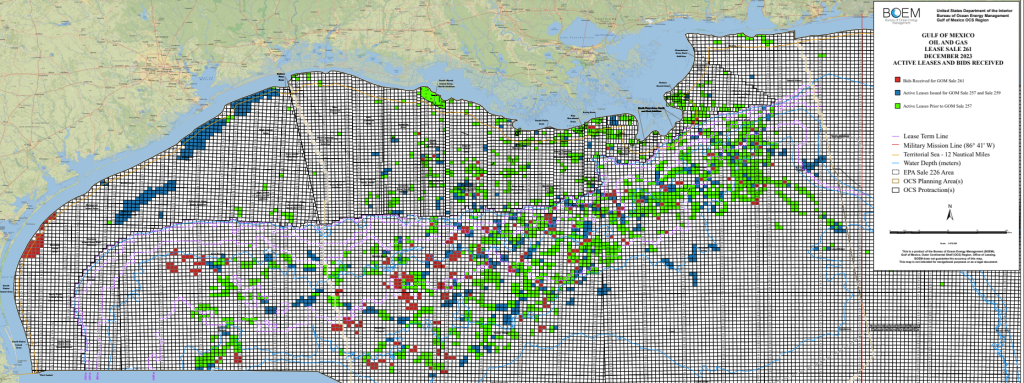

Exxon must have thought they had a clear path forward after 11th hour additions to the “Infrastructure Bill” authorized carbon disposal on the OCS, exempted such disposal from the Ocean Dumping Act, and provided $billions for CCS projects. Keep in mind that the Infrastructure Bill was signed just two days before OCS Oil and Gas Lease Sale 257, at which Exxon acquired 94 leases for carbon disposal purposes.

What the Infrastructure Bill did not provide is authority to acquire carbon disposal leases at an oil and gas lease sale. Now the lobbyists are apparently scrambling to overcome that obstacle administratively.

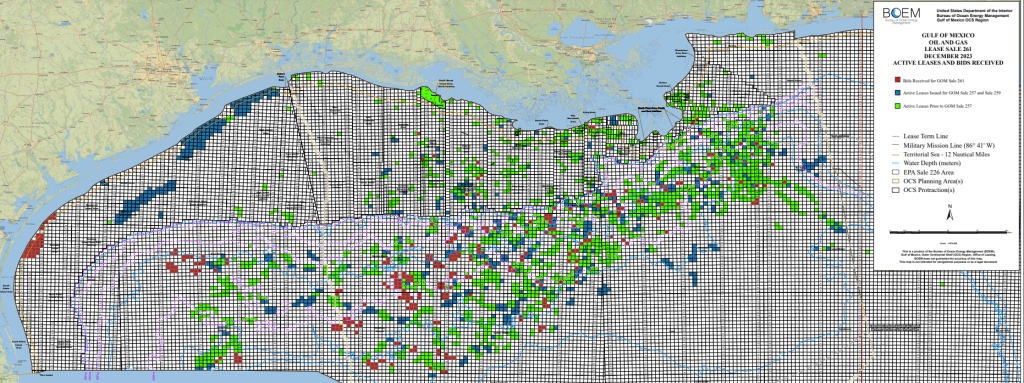

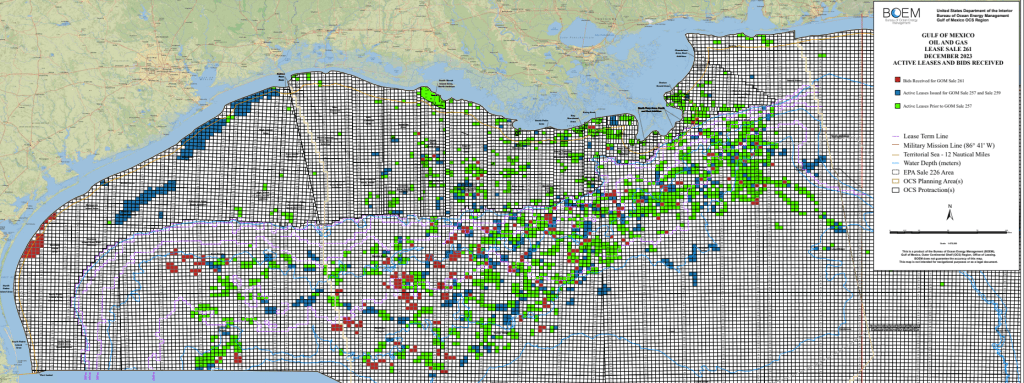

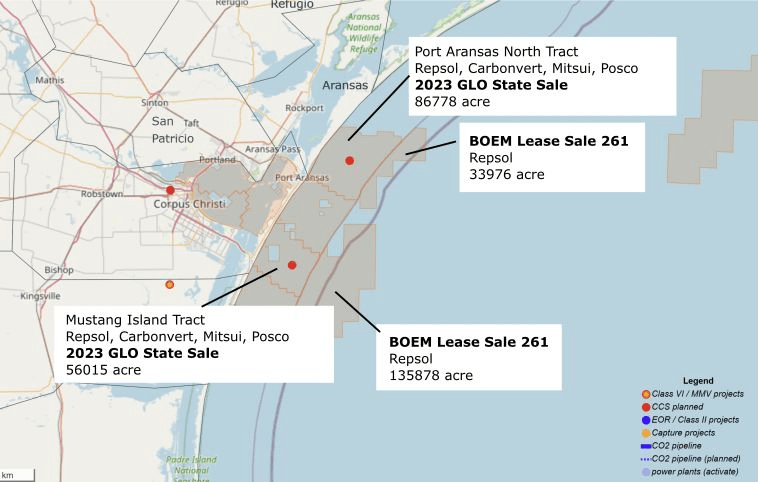

BOEM, which arguably made a mistake in accepting irregular carbon disposal bids at the last 3 oil and gas sales, should not amplify Exxon’s unfair advantage (also Repsol at Sale 261) by allowing the conversion of these leases (map below). This is not a small matter given that Exxon has publicly projected that carbon disposal is a $4 trillion market opportunity.

A single company or small group of companies should not be dictating the path forward for the Gulf of Mexico. Super-major Exxon is a relative minnow in the Gulf of Mexico OCS. They have not drilled an exploratory well since 2018, not drilled a development well since 2019, operate only one platform (Hoover, installed in 2000), ranked 11th in 2023 oil production, and ranked 29th in 2023 gas production.

Lastly, and most importantly, public comment on the myriad of technical, financial, and policy issues associated with GoM carbon disposal is imperative. That input is essential before final regulations are promulgated.