15,531 of the 15,537 comments on the bid adequacy rule were from a single organization, Friends of the Earth. I have no problem with the Friends of the Earth campaign given that their comment letter is pertinent to the topic. Their main point is that the bid adequacy process fails “to factor in the climate and social costs of continued Outer Continental Shelf oil and gas lease sales into the bid process.” Although that may be a reasonable position, those issues are addressed in the programmatic and sale specific environmental reviews which factor into when and where sales are held, tract exclusions, special lease stipulations, and the comprehensive operating regulations. Once bids are submitted, the issue (and the sole purpose of the bid adequacy rule) is whether those bids represent fair market value for the oil and gas resource potential of the leases being offered.

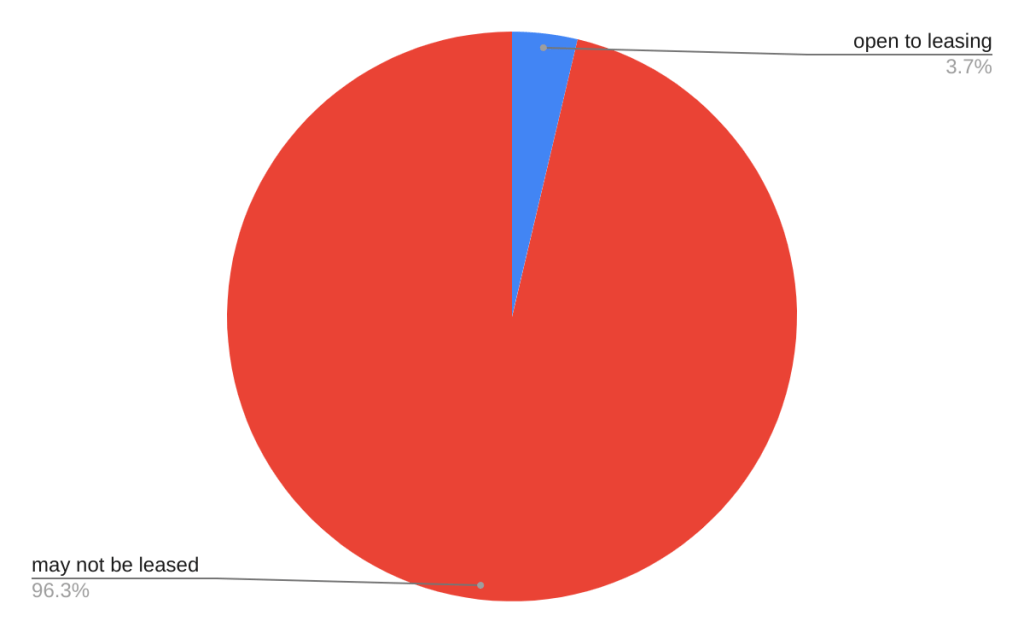

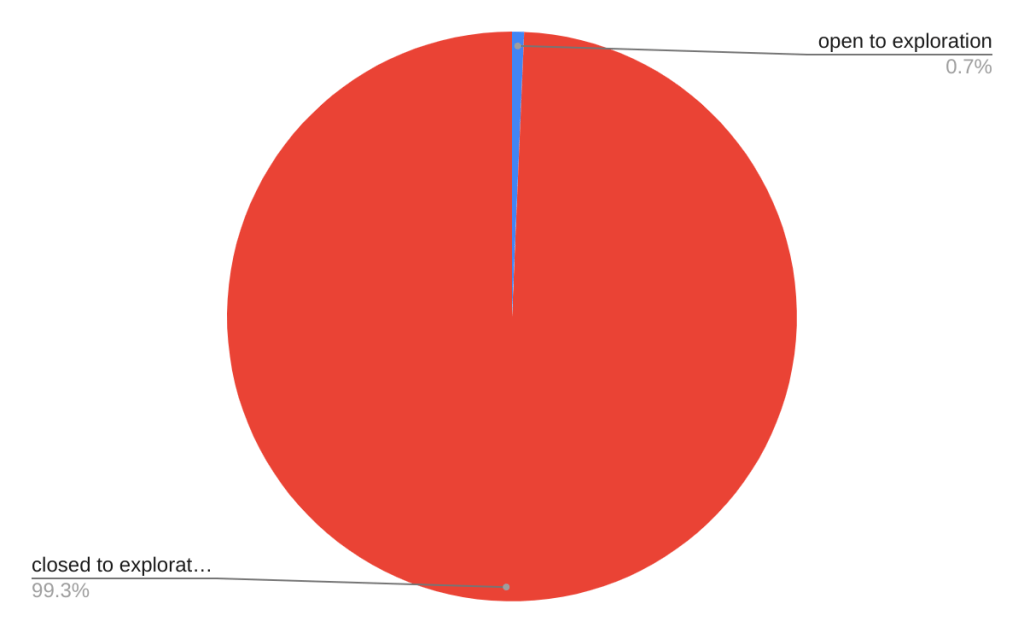

Given that 96.3% of the US OCS is off-limits to oil and gas leasing, only 0.7% is currently open to exploration, and the new 5 year plan includes the fewest lease sales in OCS program history, it’s rather a stretch to argue that environmental concerns are not being prioritized.

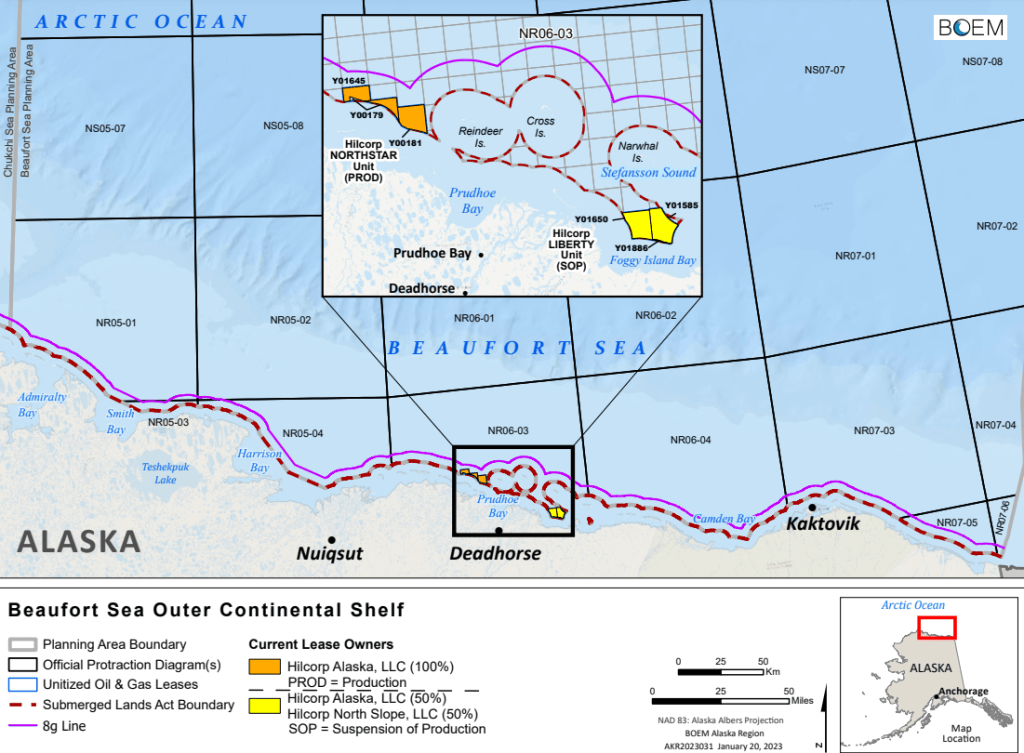

The State of Alaska submitted very good comments (attached) that point to the historical differences in Gulf of Mexico and Alaska leasing. The State argues that a simpler approach to determining fair market value would encourage exploration and development on offshore lands that have seen little of either in recent years. Knowing BOEM’s expectations prior to the sale, perhaps through higher minimum bid requirements, would ensure that companies do not underbid and that tracts are successfully leased.

The Gulf of Mexico leasing program of today is looking more like the frontier area leasing of the past. As previously noted, the uncertainty regarding future sales changes the historic GoM leasing dynamic. The next opportunity for purchasing unleased GoM tracts is now a troubling unknown. This would seem to make it less prudent to reject bids based on uncertain prospect evaluations. Absent leasing and exploration, the true resource and revenue potential will never be known.

It was good to see the strong comments submitted by my former Minerals Management Service colleagues Dr. Marshall Rose and Ted Tupper. Marshall, who was our Chief Economist, commented that the proposed rule did not identify the problem and explain how the rule addressed that problem. Ted, a senior statistician, points to past failures of the bid adequacy process and proposes specific changes. It’s great to see the passion that our retired employees have for the program they were so instrumental in developing and managing.

The rule was finalized without any substantive changes.

Read Full Post »