Florida HB 1645 (attached) was signed by Gov. DeSantis on 5/15/2024. The bill boosts natural gas, prohibits offshore wind turbines, and deletes references to climate change and greenhouse gases in state law. Given the State’s support for traditional energy sources, is it time to renew the dialogue about exploration and production in the Eastern Gulf of Mexico (EGOM)?

HB 1645 prohibits offshore and coastal wind development (p. 30), acknowledges that natural gas is critical for power resiliency, prohibits zoning regulations that restrict gas storage facilities and gas appliances (p.8), and relaxes permitting requirements for pipelines <100 miles long.

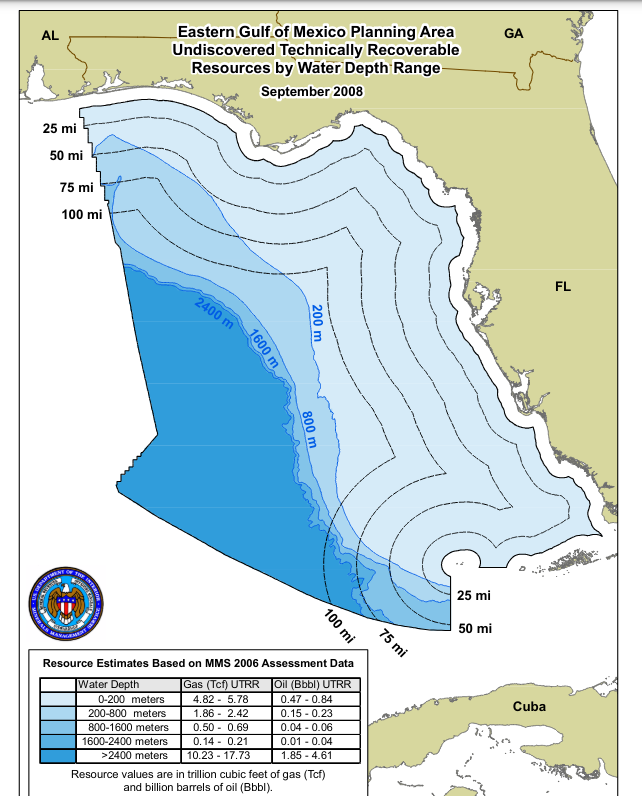

Given Florida’s energy preferences as expressed in this legislation, the State could assist regional energy planners by better defining its position on oil and gas leasing in the EGOM. What limits, in terms of lease numbers and minimum distances from shore, would best improve Florida’s energy supply options while further minimizing environmental risks?

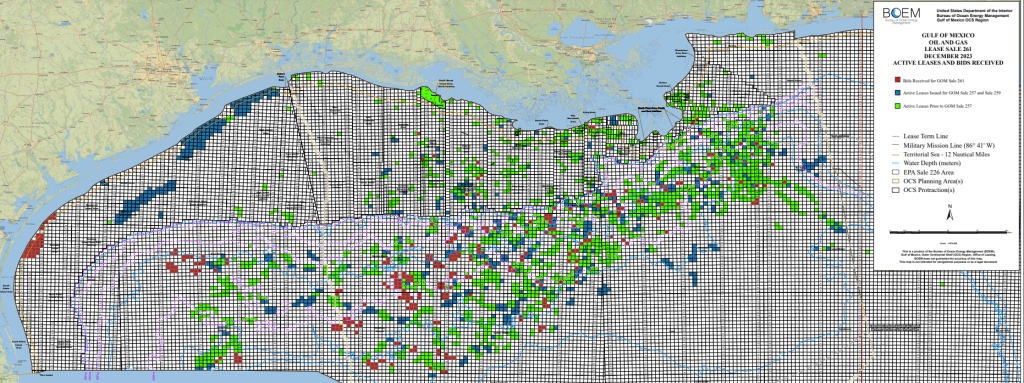

As illustrated on the map below, the petroleum geology of the EGOM and Florida’s preferences are likely aligned in that the best prospects for oil and gas production are in deep water and more than 100 miles from the State’s coast. Does Florida support a 100 mile buffer?

The 4/20/2010 Macondo blowout was a tragic failure that has been, and will continue to be, discussed at length on this blog. We should also acknowledge that prior to Macondo 25,000 wells were drilled on the US OCS over a 25 year period without a single well control fatality, an offshore safety record that was unprecedented in the U.S. and internationally. We should also applaud recent advances in well integrity and control, including the addition of capping stack capabilities that further reduce the risk of a sustained well blowout.

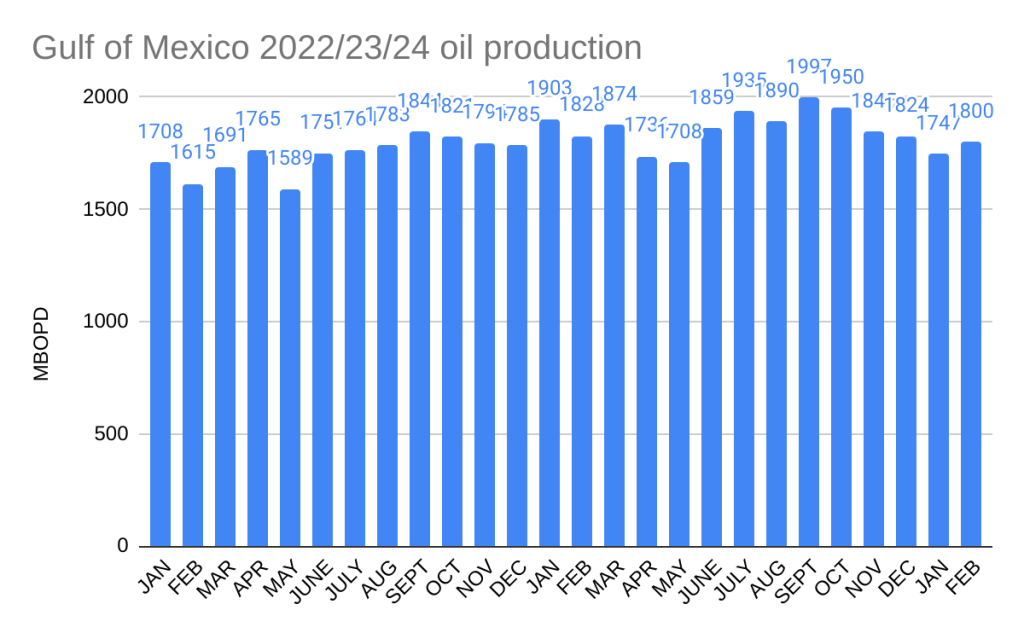

Florida’s independent thinking on energy policy is commendable. That independence is contingent on importing petroleum products and natural gas from elsewhere in the Gulf region. Securing that supply over the intermediate and longer term should be a priority for Florida. In that regard, EGOM production is an important consideration.