Posted in Uncategorized | 5 Comments »

Only 13 companies participated in the lease sale:

- Chevron .

- Shell

- Walter

- Houston Energy

- LLOG (now owned by Harbour Energy)

- Oxy/Anadarko

- Woodside

- BP

- Red Willow

- Focus Exploration

- Renaissance Offshore

- Navitas Petroleum

- CL&F Offshore

The No-Shows:

US supermajors once active in the Gulf that have become perennial No-Shows:

- Exxon

- ConocoPhillips

International majors with a Gulf presence:

- Equinor

- Eni

- Total

- Petrobras

- Repsol

Typically active independents

- Arena

- Cantium

- Beacon Offshore

- Talos

- Kosmos

- Murphy

Why was the participation so poor?

- Only 3 months between BBG1 and BBG2

- Lease sale certainty reduces urgency

- Concerns about longer term policy changes?

- Mergers reduce participation and competition?

- New ownership, change in priorities?

- More limited geologic prospectivity?

It would be helpful to hear from some of the companies that chose not to participate.

Posted in energy policy, Gulf of Mexico, Offshore Energy - General | Tagged BBG2, low participants, no-shows, OCS lease sale, poor results | Leave a Comment »

Although no one was expecting a barnburner only 3 months after the previous sale, BBG2 was historically weak for a Gulf-wide sale. The table below compares BBG2 with the previous 4 Gulf sales, none of which were particularly impressive.

However, the sale was not without highlights. There was some spirited bidding for tracts in the Green Canyon area. BP’s bid was the highest of 5 for GC Block 404. BP bid $21 million for the block, 45% of the high bids sum for the entire sale. The BP bid was also $20 million higher than the next highest bid for that tract (ouch!).

Also interesting was Chevron edging Shell $5,887,188.00 to $5,501,240.00 to acquire GC Block 492.

| Sale No. | 257 | 259 | 261 | BBG1 | BBG2 |

| date | 11/17/2021 | 3/29/2023 | 12/20/2023 | 12/10/2025 | 3/11/2026 |

| companies participating | 33 | 32 | 26 | 30 | 13 |

| total bids | 2233 | 2842 | 3161 | 219 | 38 |

| tracts receiving bids | 2143 | 2442 | 2751 | 181 | 25 |

| sum of all bids $millions | 198.5 | 309.8 | 441.9 | 371.9 | 69.9 |

| sum of high bids ($millions) | 101.7 | 263.8 | 382.2 | 279.4 | 47.0 |

| highest bid company block | $10,001,252 Anadarko AC 259 | $15,911,947 Chevron KC 96 | $25,500,085 Anadarko MC 389 | $18,592,086 Chevron KC 25 | $21,009,990 bp GC 404 |

| most high bids company sum ($millions) | 46 bp 29.0 | 75 Chevron 108.0 | 65 Shell 69.0 | 50 bp 61.0 | 6 Anadarko (Oxy) 4.0 |

| sum of high bids ($millions) company | 47.1 Chevron | 108 Chevron | 88.3 Hess | 61.0 bp | 22.6 bp |

| most high bids by independent | 14-DG Expl. | 13-Beacon 13-Red Willow | 22-Red Willow | 14-Murphy | 5-LLOG |

For historical comparison purposes, Gulf Sale 206 drew $3.7 billion ($5.6 billion in today’s dollars) in 2008. Twenty-siz sales between 1972 and 2013 garnered more than $1 billion in high bids.

Posted in energy policy, Gulf of Mexico, Offshore Energy - General | Tagged BBG2, bp, Chevron, Gulf of America, historically weak, lease sale, Shell | Leave a Comment »

Sen. Mike Lee has introduced legislation to repeal the Jones Act, which is drawing additional scrutiny for the increased cost of transporting US oil production and LNG to US ports.

Because facilities on the Outer Continental Shelf are US ports under the Jones Act, the Act has been problematic for both the offshore oil and wind industries. The attached Customs and Border Patrol document delves into the nuances of Jones Act compliance for lifting operations (p.14-15) and “points” on the OCS (p.17).

EXAMPLE: CBP interprets the OCSLA to extend the Jones Act to artificial islands and similar structures, as well as to mobile oil drilling rigs, drilling platforms, and other devices attached to the seabed of the OCS for the purpose of resource extraction and/or exploration operations. Such objects located on the OCS are considered points or places in the United States for purposes of the Jones Act. Similarly, floating warehouse vessels, when anchored on the OCS to supply drilling rigs on the OCS, are also coastwise points.

Check out this complex CBP ruling on the transportation of well fluids from one location in a subsea well cluster to another. See if you understand and agree with their conclusion (below).

The transportation of fluids as described in the FACTS section above, by a dynamically-positioned, foreign-flagged drill ship between wells located within an IF (integrated facility), which subsequently, transships the fluids to a coastwise qualified barge for transportation to a coastwise point, violates 46 U.S.C. § 55102.

On a related matter, it’s still unclear to me whether the attachment of the lower marine riser package to a subsea wellhead makes a floating, dynamically positioned drillship a US port under the Jones Act.

Posted in energy policy, Offshore Energy - General, Regulation | Tagged CBP, Jones Act, OCS facilities, offshore drilling, Offshore Wind, oil production, repeal, Senator Mike Lee | Leave a Comment »

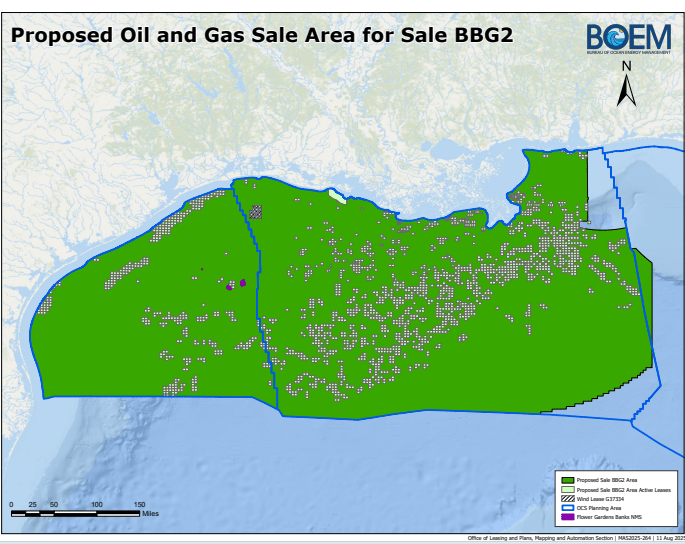

Gulf of America oil and gas lease sale BBG2 will be held tomorrow. The Notice of Sale is attached.

Although Big Beautiful Gulf 1 (BBG1) was rather lackluster, BBG 2 is unlikely to match it in terms of the number of bids and their sum. Prior to BBG1, there had been no lease sale for two years. BBG 2 is being held only 3 months later.

Given the short duration between sales, the bid evaluations for BBG1 are not yet completed. However, the sale notice advises that any block which received a bid in BBG1 is excluded from BBG2.

Will the recent increase in oil prices influence bidding? Probably not given the longer term nature of offshore development and expectations that the current price spike will be of short duration. Onshore shale oil production is more responsive to price fluctuations.

Posted in energy policy, Gulf of Mexico, Offshore Energy - General | Tagged BBG1, BBG2, bids, expectations, lease sale, oil and gas | Leave a Comment »

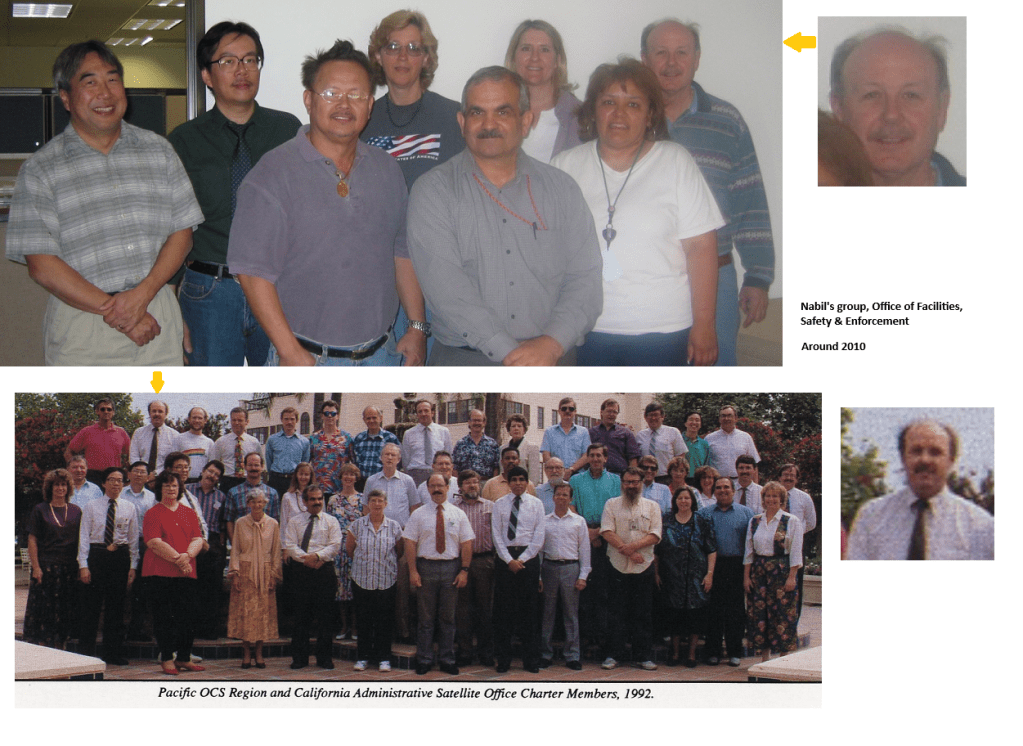

On February 27, 2026, we lost a long-time pillar of the OCS safety program, the foremost authority on California offshore oil and gas operations, and a wonderful friend and colleague.

Glenn Shackell grew up in Hawthorne, California, where he lived most of his life. He attended Hawthorne High with the Beach Boys!

Glenn served as a helicopter door gunner during the Vietnam War, an extremely hazardous assignment. According to historical accounts, the average life expectancy of a door gunner was two weeks. Think about that!

Glenn discussed his Vietnam experience with Minerals Management Service (MMS) colleague Andrew Konczvald:

“Glenn told me about encounters when the bullets were hitting the bottom of his Huey helicopter, and he was sitting on his personal armored jacket as the only protection against the bullets! He told me how he prayed every night and miraculously escaped wounds and returned home safely.“

Thankfully, Glenn survived and returned to earn a Petroleum Engineering degree from the Univ. of Southern California. He was a proud USC Trojan.

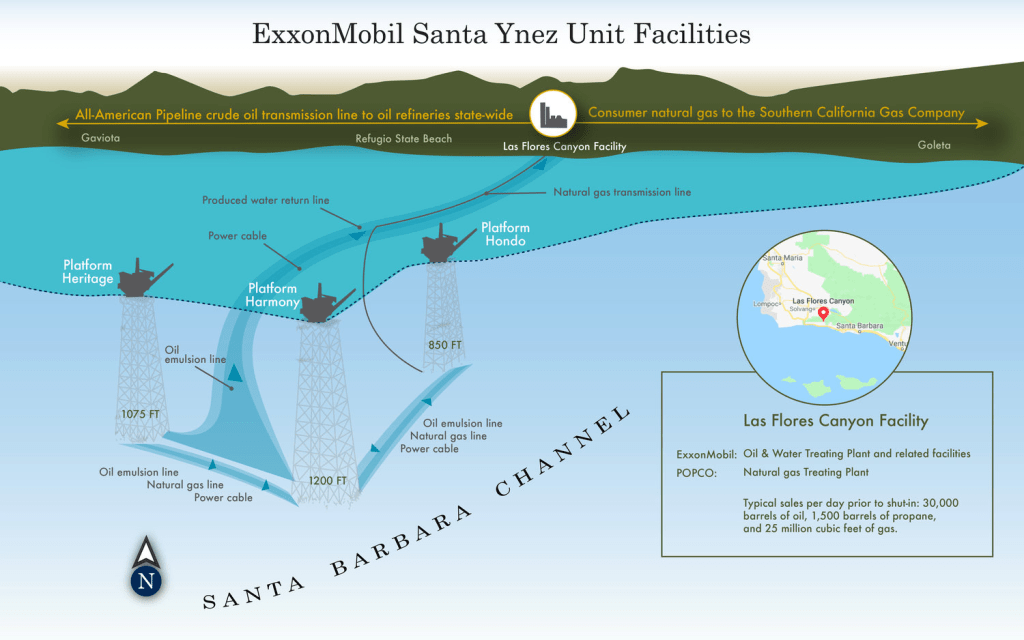

Glenn had an outstanding career in our Pacific Region office, starting in the early days when the OCS regulatory program was part of the US Geological Survey. He assessed and monitored drilling and production operations in the region, which once produced 120,000 bopd from 23 platforms, and had up to 9 mobile drilling units operating concurrently. Floating drilling operations were pioneered offshore California with the CUSS 1, and production was extended to 1200 feet of water at Platform Harmony.

Glenn had an encyclopedic knowledge of the California offshore sector, and was an expert on the history of the applicable regulations, orders, and standards. We had countless discussions about topics like OCS Order No. 2 (Drilling) and the evolution of API RP 14C (Production Safety Systems).

Glenn served on numerous MMS teams that evaluated the latest technical innovations of the offshore industry, established research priorities, and assessed safety and environmental performance. He was an authority on drilling safety and was called on to evaluate and accredit well control training programs.

Glenn respected everyone, and everyone admired and respected him. He was a man of faith, but didn’t impose his beliefs on others. Fittingly, his favorite Bible passage was John 11:25-26: Jesus tells Martha, “I am the resurrection and the life. The one who believes in me will live, even though they die; and whoever lives by believing in me will never die.”

RIP Glenn, you continue to inspire your friends, and your important contributions to society live on. We love you man!

Posted in California, Offshore Energy - General, Regulation, Uncategorized | Tagged California, Glenn Shackell, Minerals Management Service, offshore safety, RIP, USGS | 2 Comments »

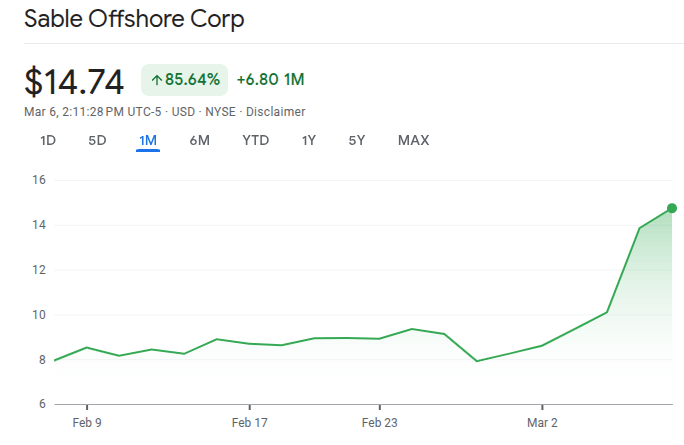

Big move by SOC following the issuance of the DOJ opinion. Justified optimism or irrational exuberance?

Posted in California, energy policy, Offshore Energy - General, pipelines, Regulation, Uncategorized | Tagged Dept. of Justice, irrational exuberance, legal opinion, Sable Offshore, Santa Ynez Unit | Leave a Comment »

Attached is an opinion prepared by the Assistant Attorney General, Office of Legal Counsel, for the General Counsel, Dept. of Energy. This opinion may boost prospects for Santa Ynez Unit (SYU) production, either by Sable Offshore or a successor.

BOE SYU watchers see this State-Federal battle ultimately ending up in the Supreme Court, perhaps following the 9th Circuit’s ruling on PHMSA’s preemption of State authority over the onshore pipeline segments.

A few key excerpts from the DOJ opinion (emphasis added):

p. 1: You have asked whether an order issued under the Defense Production Act of 1950 (“DPA” or “Act”), Pub. L. No. 81-774, 64 Stat. 798 (codified as amended at 50 U.S.C. § 4501 et seq.), to Sable by the President or his delegee would preempt the California laws currently impeding Sable from resuming production and operating the associated pipeline infrastructure. We conclude that it would.

p. 6: As the Supreme Court has explained, executive orders “may create rights protected against inconsistent state laws through the Supremacy Clause,” especially when such orders are issued pursuant to “congressional authorization.”

p. 20: State law, we have been advised, is not currently the only impediment to Sable’s ability to resume production and transportation of oil. A consent decree entered in United States v. Plains All American Pipeline L.P., No. 20-cv-02415 (C.D. Cal. Oct. 14, 2020), Dkt. 33 (“Consent Decree”), “currently vests authority over resumption of transportation through the onshore portions of the Santa Ynez Pipeline System with the California Office of the State Fire Marshal.” Sable Letter at 9. We have been advised that, in addition to the United States and various State of California entities, Sable is a party to the Consent decree as a result of an acquisition. You have asked whether an executive order under the DPA would displace these provisions of the Consent Decree, even though there are both federal- and state-law claims at issue in that case. For three reasons, we think it would.

Posted in California, energy policy, Offshore Energy - General, pipelines, Regulation | Tagged 9th circuit, DOE, DOJ Opinion, DPA, Federal supremacy, PHMSA, Sable Offshore, Santa Ynez Unit, SCOTUS | Leave a Comment »

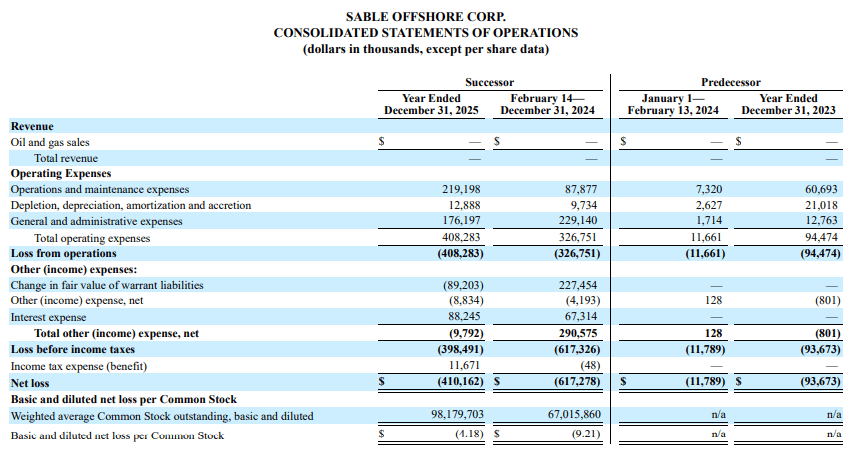

The potential rewards are great – 500+ million barrels of oil, 3 major production platforms, associated pipelines, onshore processing facilities – but can Sable survive the costly legal and administrative challenges? What is Exxon’s plan for the Santa Ynez Unit if Sable should fail?

Posted in California, energy policy, Offshore Energy - General, pipelines, Regulation | Tagged $408 million loss, Exxon, Sable Offshore, Santa Ynez Unit | Leave a Comment »

The results of today’s Cook inlet oil and gas lease sale are disappointing, but not surprising.

BOEM: At this time, no bids have been received. In accordance with OBBBA, we will continue to hold leasing opportunities for Cook Inlet so that industry has a regular, predictable federal leasing schedule that ensures we achieve President Trump’s American Energy Dominance Agenda.

Posted in Alaska, energy policy, Offshore Energy - General | Tagged BBC1, Cook Inlet, lease sale, no bids, oil and gas | Leave a Comment »

A post from October 13, 2023, is re-posted below due to its current relevance.

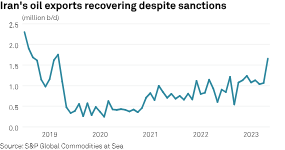

S&P Global reports on the surge in Iranian oil production and exports. In the quote below, note the concern about the higher oil prices that might result from tightening the sanctions. If oil price concerns are driving critical foreign policy decisions, this would be a rather stunning indictment of US energy policy, which is sometimes perceived as being more hostile toward domestic producers than international adversaries.

“Before the war, US-Iranian tensions had eased, which facilitated higher Iranian oil exports. Iranian crude oil production increased 500,000 b/d from March to September 2023 — to 3.1 million b/d from 2.6 million,” the analysts said. “Biden will be under pressure to enforce sanctions and curtail Iranian export revenue. This is a challenging situation for the Biden administration, which wants more oil on the market, not less. The attacks on Israel could override the oil issue.“

There was an exchange on this topic at yesterday’s White House press briefing:

Q. I wanted to ask you about oil, if I could, and the money that it’s bringing in. So, is the amount of oil that’s being brought in by Iran — specifically, records amount, 85 percent to China, more oil being sold above the price cap from Russia — giving the President any pause on changing these energy policies for fossil fuels here in the U.S.?

MR. KIRBY: I would — just let me back up a little bit. I mean, it’s important to remember that Iran gets most of its oil revenue off the black market and evad- — evading sanctions, which they do. It’s costly to them. In fact, our evidence is that they really only receive a fraction of the market value of the oil that they sell, because they have to sell it on the black market.

We will always, as we do in any case, typically, revisit sanctions regimes to see if they need to be changed or adjusted, specifically with respect to Iranian oil.

The President, since the beginning of the administration, has been concerned about making sure we have a viable global market for oil, working hard to keep the prices of gasoline down here in the United States. Part of that is making sure you remove some of the volatility in that global supply and demand.

I don’t have any announcements or decisions to make today with respect to any changes to the domestic oil production.

Q But isn’t it a national security issue when you have countries that are profiting off of oil and the increased price of oil that don’t like Israel, that don’t like America?

MR. KIRBY: We don’t want, for instance, Russia to be able to — to get a windfall in profits from the oil market so that they can then turn that around and — and apply that to weapons in Ukraine. We certainly don’t want to see Iran do — be able to do much of the same, which is why we’re — we’re putting as much pressure on them as we are.

Q So, why not increase oil production here?

MR. KIRBY: I — again, I don’t have any announcements to make today.

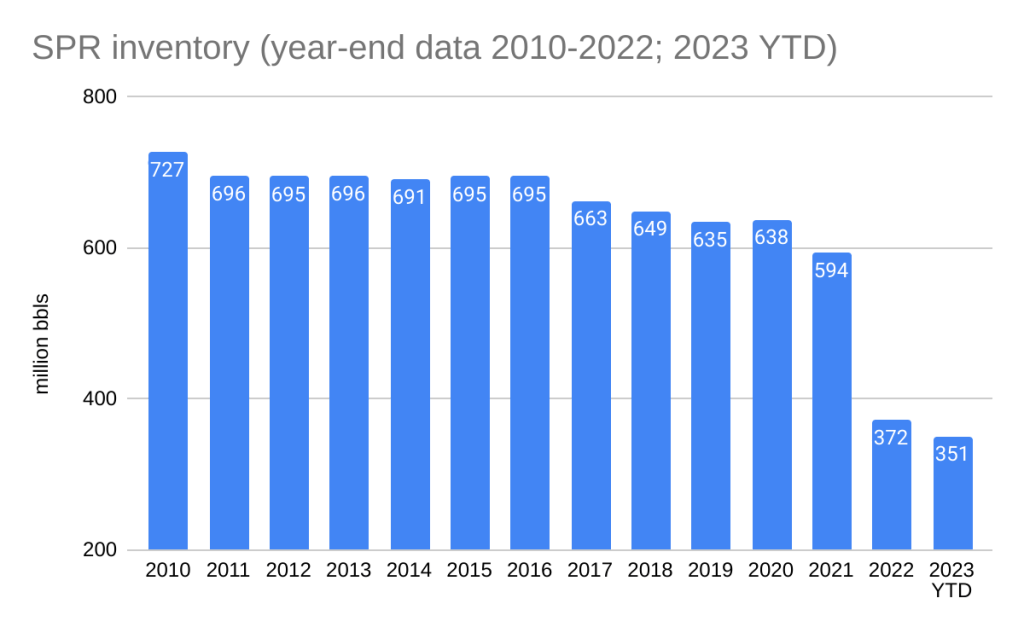

On a related note, the Strategic Petroleum Reserve has remained at historic low levels. The current volume is 351.3 million barrels, a slight rise from the low of 346.8 million barrels in July, the lowest volume since 8/19/1983 when the SPR was still being filled. Have the oil embargoes following the Yom Kippur War, the reason for the SPR’s existence, been forgotten?

Posted in energy policy | Tagged Biden, Iran, Israel, sanctions, SPR | Leave a Comment »