The subject Nature Energy paper is helpful in that it contributes to the important dialogue on the financial aspects of offshore decommissioning. There have been numerous posts on that topic on this blog. The use of Federal funds to cover well abandonment expenses for OCS wells, although rather limited to date, is a major disappointment for those of us who have worked hard to prevent such an outcome.

The data in the paper appear to be reasonably accurate. However, there is one glaring error regarding Pacific operations, and the reference to the Macondo blowout in the environmental discussion is rather provocative and misleading.

Per the authors:

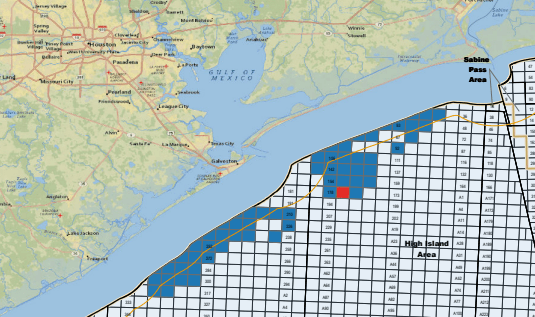

California wells are drilled in relatively shallow water—mostly less than 100 feet—while GoM wells can be in up to 10,000 feet of water.

California’s fault block shelf drops off very quickly, and deepwater drilling activity has been common for decades. Of the 23 platforms in Federal waters, only Platform Gina is in <100′ of water (95′). The other platforms are in water depths of 154 to 1178′. Six of the platforms are in >600′ of water and 2 are in >1000′. Platform Harmony (jacket pictured below) is one of the world’s largest and heaviest steel tower platforms. Relative to the numbers of facilities, the decommissioning challenges offshore California are more daunting and complex than those in the Gulf. This includes the financial liability aspects.

With regard to the environmental risks, the Nature Energy paper’s reference to the Macondo blowout, while muted, is what some media outlets embraced. Per the authors:

Releases from improperly abandoned wells will probably be chronic and small compared with Macondo, but the underlying biochemical and ecological processes that influence the ecological impacts have many similarities.

The Macondo well blew out while it was being suspended in preparation for subsequent completion operations. Ill advised changes to the well suspension plan were among the primary contributing factors to the blowout (see diagram below). The Macondo well was entirely different from the depleted end-of-life wells that are the subject of the paper.

Some media outlets ran with the Macondo angle, weak as it was. This ABC news piece featured numerous Macondo pictures. Other outlets noted that Macondo was a temporarily abandoned well, which it was not. The Macondo well never got to that point.

National Commission, Chief Counsel’s Report, p. 132