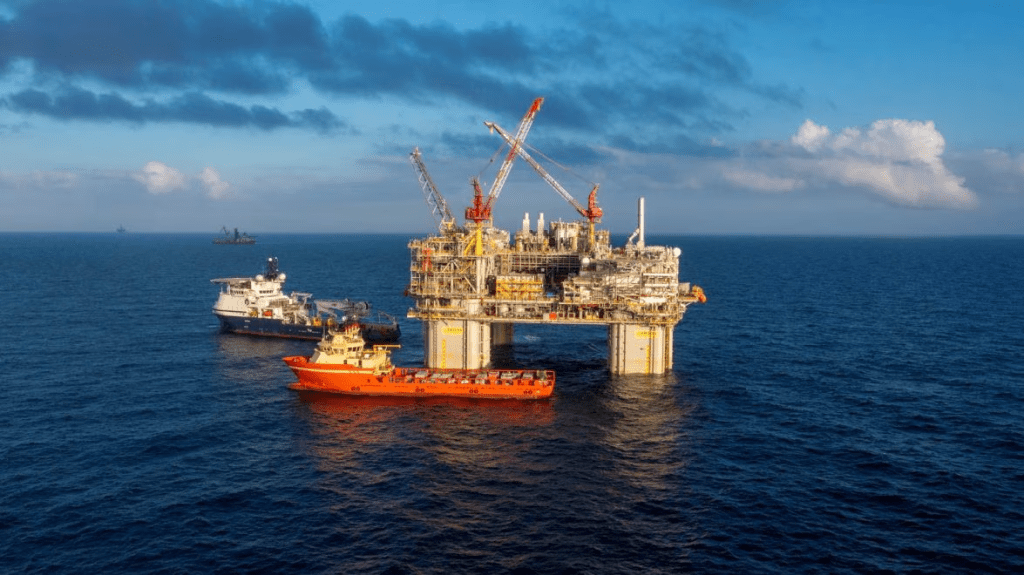

BP has announced it will cut its renewable energy investments and instead focus on increasing oil and gas production.

The energy giant revealed the shift in strategy on Wednesday following pressure from some investors unhappy its profits and share price have been lower than its rivals.

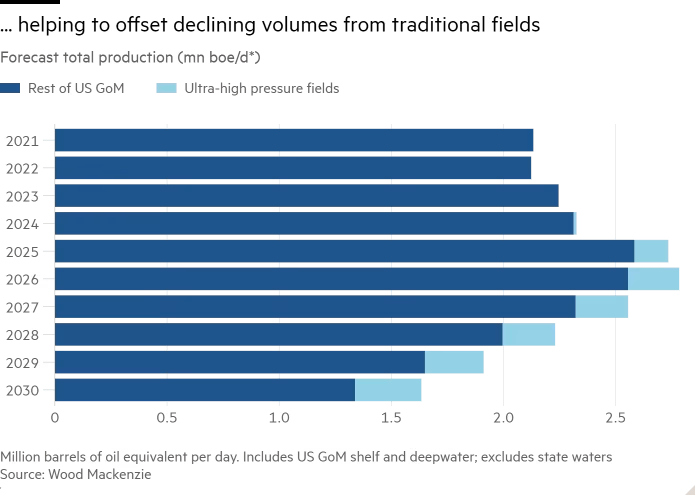

BP said it would increase its investments in oil and gas by about 20% to $10bn (£7.9bn) a year, while decreasing previously planned funding for renewables by more than $5bn (£3.9bn).

It’s more than okay to be an oil and gas producer – no need to apologize or pretend to be something else. Oil and gas are, and will continue to be, essential to economies worldwide. Companies should focus on safely and cleanly achieving production objectives.

If a company thinks other types of energy investments make good business sense, they should engage in those activities. However, they should not do so to curry favor with anti-oil factions who can never be placated. Attempts to do so will only weaken your company.

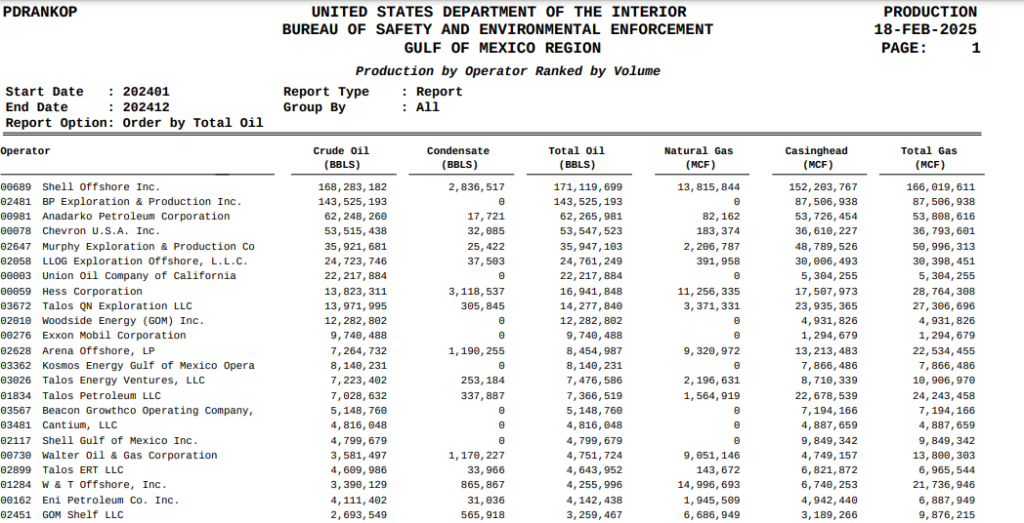

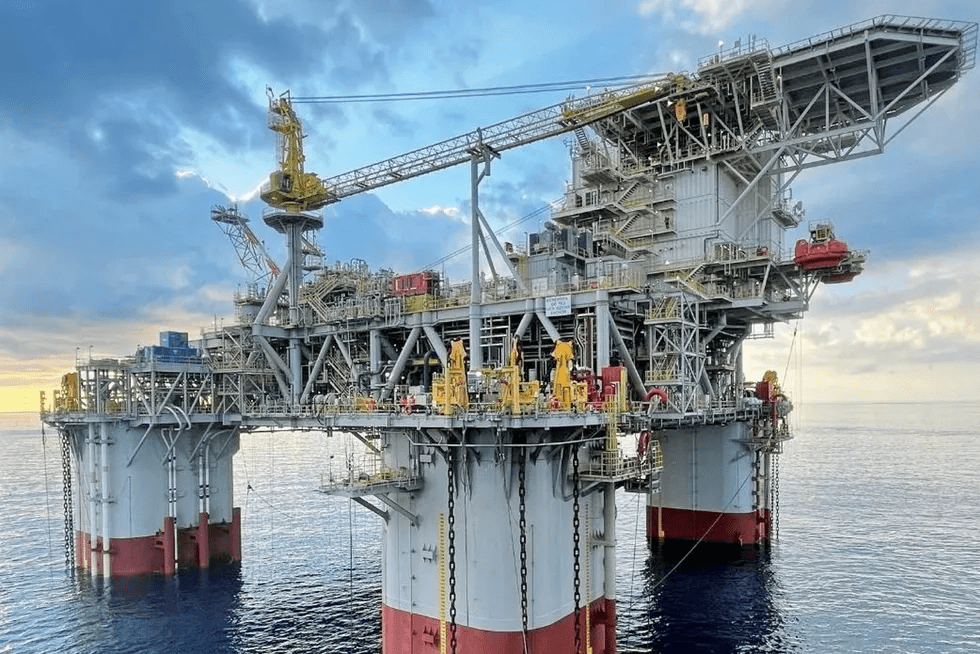

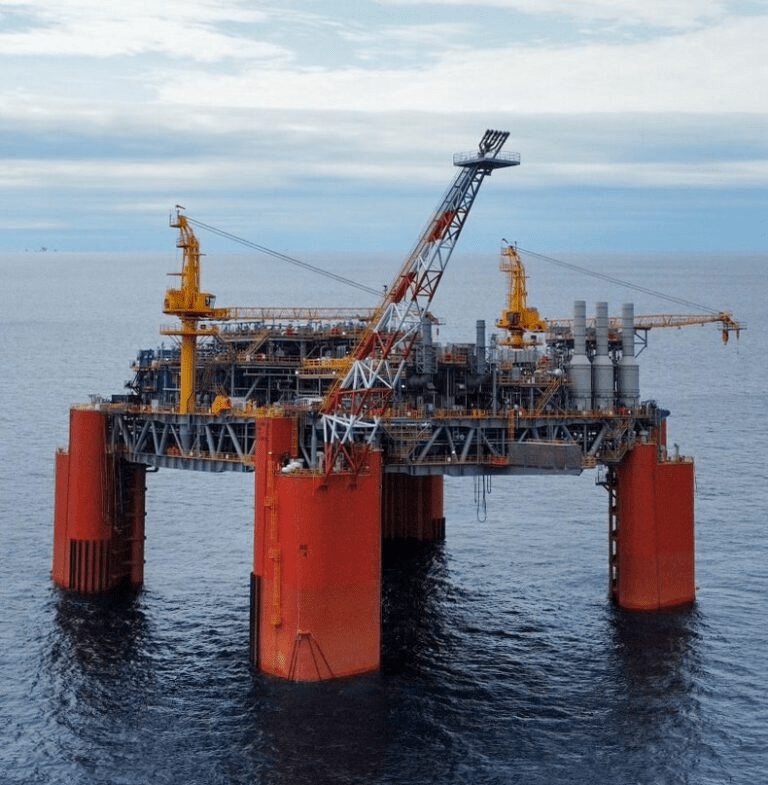

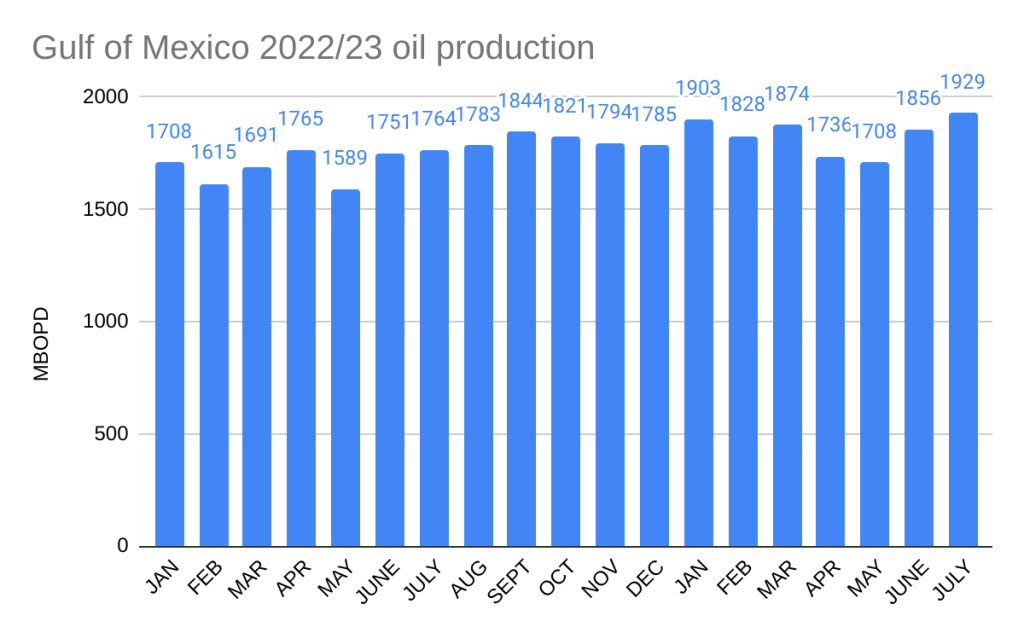

BP is doing well in the Gulf of America – no. 2 producer in 2024.