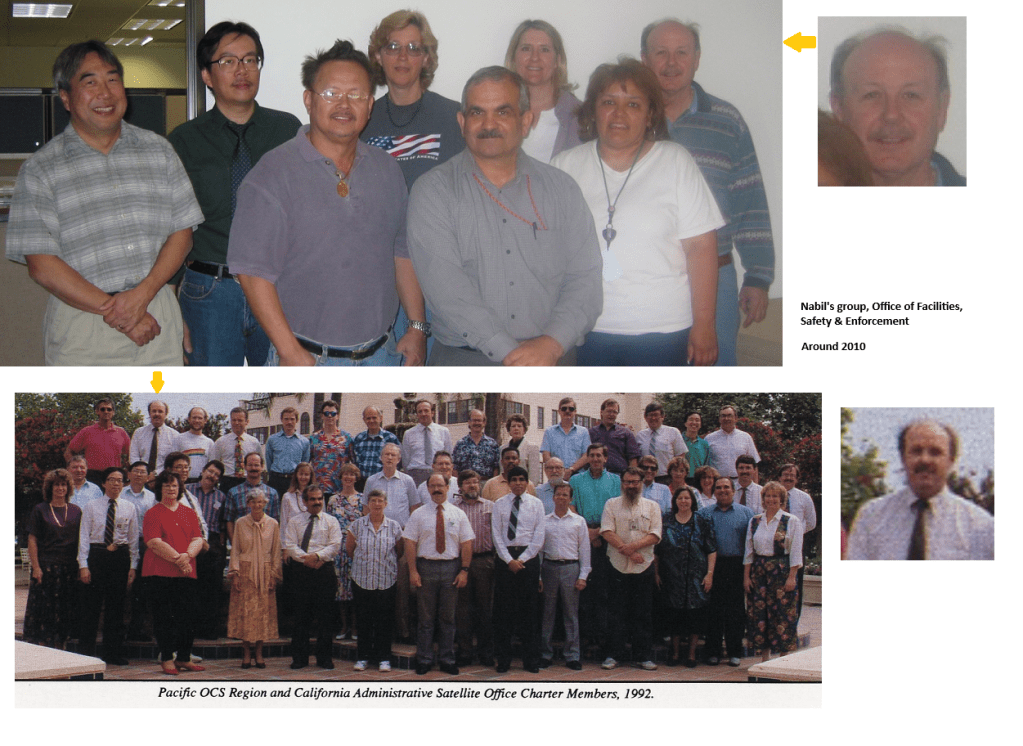

On February 27, 2026, we lost a long-time pillar of the OCS safety program, the foremost authority on California offshore oil and gas operations, and a wonderful friend and colleague.

Glenn Shackell grew up in Hawthorne, California, where he lived most of his life. He attended Hawthorne High with the Beach Boys!

Glenn served as a helicopter door gunner during the Vietnam War, an extremely hazardous assignment. According to historical accounts, the average life expectancy of a door gunner was two weeks. Think about that!

Glenn discussed his Vietnam experience with Minerals Management Service (MMS) colleague Andrew Konczvald:

“Glenn told me about encounters when the bullets were hitting the bottom of his Huey helicopter, and he was sitting on his personal armored jacket as the only protection against the bullets! He told me how he prayed every night and miraculously escaped wounds and returned home safely.“

Thankfully, Glenn survived and returned to earn a Petroleum Engineering degree from the Univ. of Southern California. He was a proud USC Trojan.

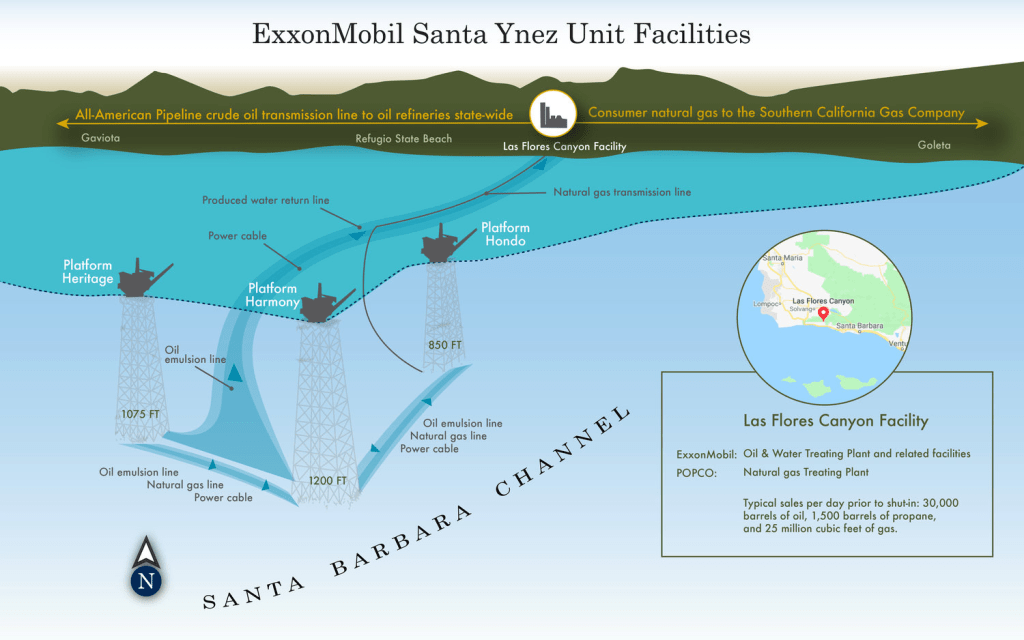

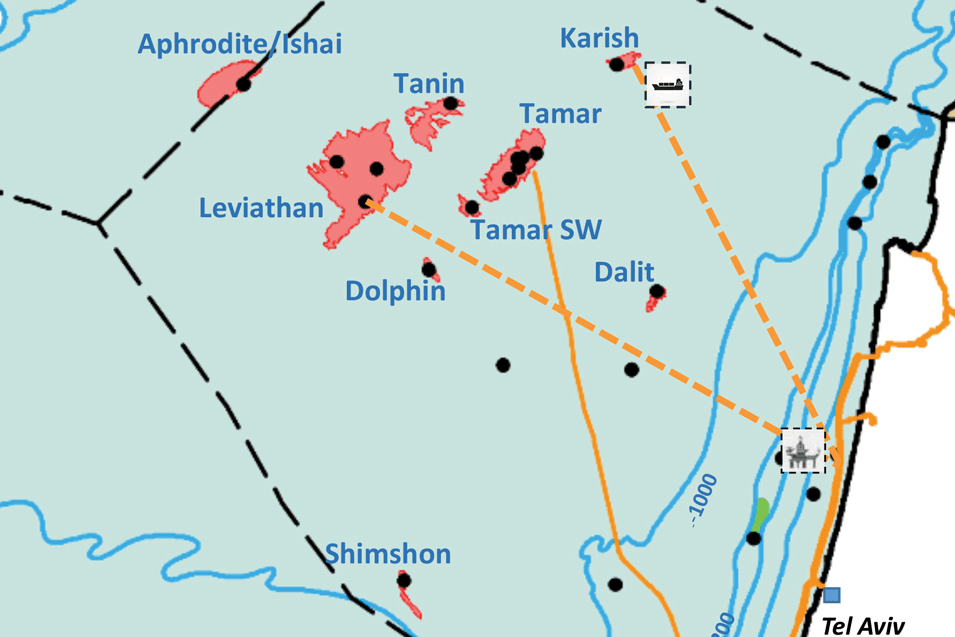

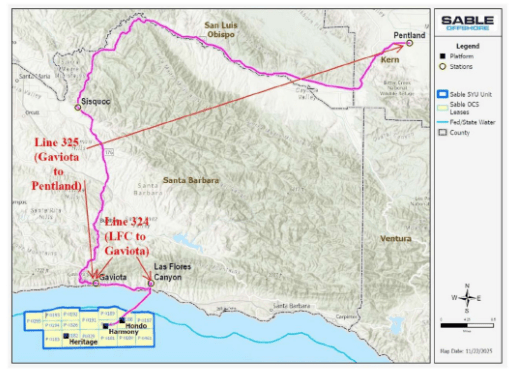

Glenn had an outstanding career in our Pacific Region office, starting in the early days when the OCS regulatory program was part of the US Geological Survey. He assessed and monitored drilling and production operations in the region, which once produced 120,000 bopd from 23 platforms, and had up to 9 mobile drilling units operating concurrently. Floating drilling operations were pioneered offshore California with the CUSS 1, and production was extended to 1200 feet of water at Platform Harmony.

Glenn had an encyclopedic knowledge of the California offshore sector, and was an expert on the history of the applicable regulations, orders, and standards. We had countless discussions about topics like OCS Order No. 2 (Drilling) and the evolution of API RP 14C (Production Safety Systems).

Glenn served on numerous MMS teams that evaluated the latest technical innovations of the offshore industry, established research priorities, and assessed safety and environmental performance. He was an authority on drilling safety and was called on to evaluate and accredit well control training programs.

Glenn respected everyone, and everyone admired and respected him. He was a man of faith, but didn’t impose his beliefs on others. Fittingly, his favorite Bible passage was John 11:25-26: Jesus tells Martha, “I am the resurrection and the life. The one who believes in me will live, even though they die; and whoever lives by believing in me will never die.”

RIP Glenn, you continue to inspire your friends, and your important contributions to society live on. We love you man!