Archive for the ‘Gulf of Mexico’ Category

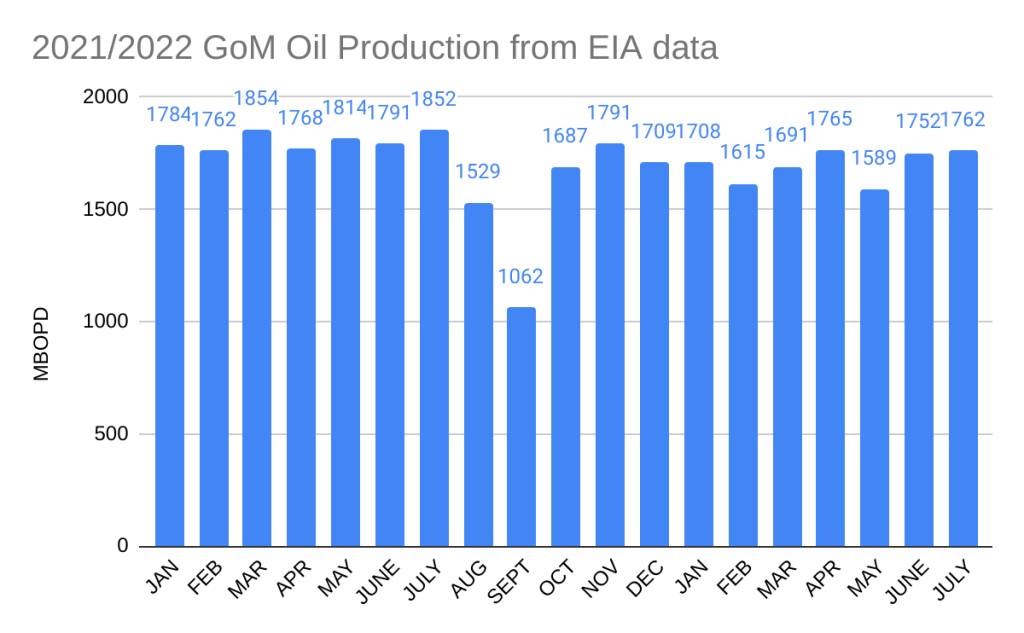

Gulf of Mexico production held steady in July

Posted in Gulf of Mexico, Offshore Energy - General, tagged EIA, Gulf of Mexico production, July oil production on September 30, 2022| Leave a Comment »

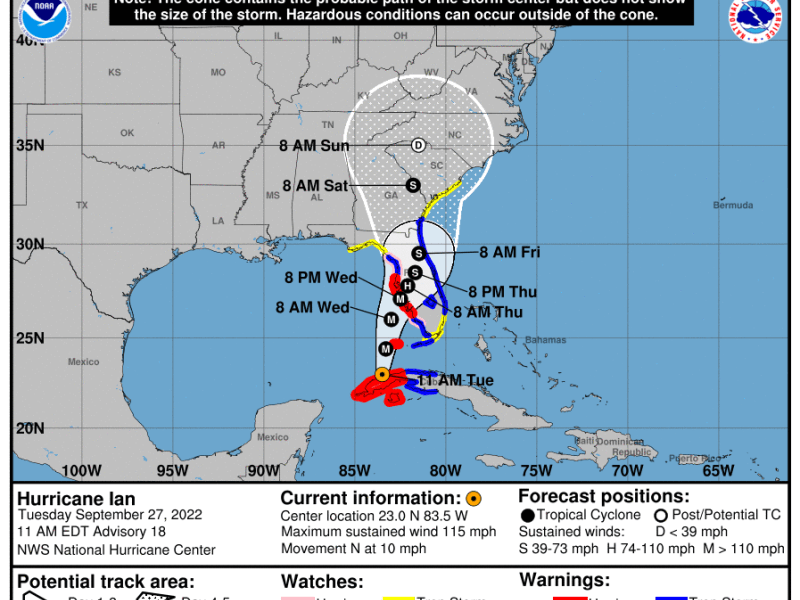

BSEE Ian update

Posted in Gulf of Mexico, hurricanes, Offshore Energy - General, tagged Gulf of Mexico, Hurricane Ian, production shut-in on September 28, 2022| Leave a Comment »

Some production has already resumed as BSEE reports that 157,706 BOPD were shut-in as of 12:30 pm ET today, down from 190,358 in yesterday’s report.

BSEE Ian shut-in report

Posted in Gulf of Mexico, hurricanes, Offshore Energy - General, tagged BSEE, Gulf of Mexico, Hurricane Ian, shut-in production on September 27, 2022| Leave a Comment »

190,358 BOPD shut-in as of 12:30 p.m. ET today. Presumably, most of the shut-in production is associated with the major deepwater platforms mentioned in our previous post. Given the projected storm track, these shut-ins should be brief.

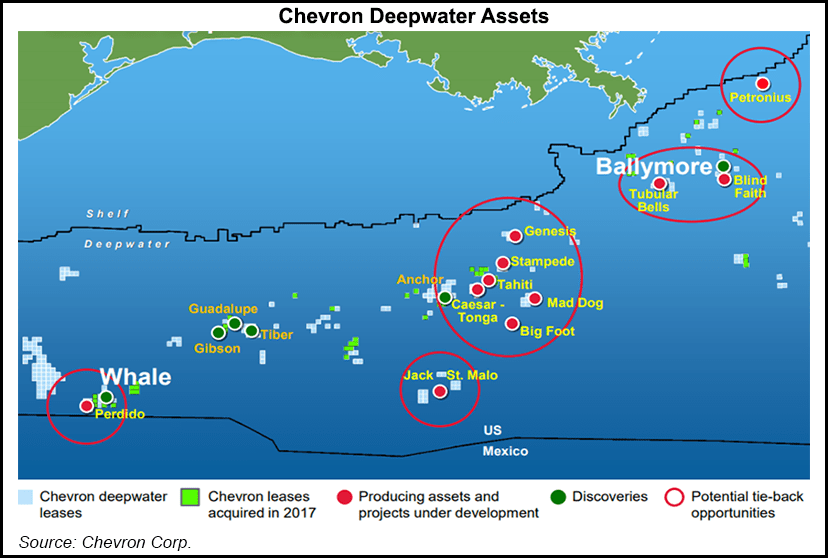

Hurricane Ian: Na Kika, Thunder Horse, Petronius, and Blind Faith shut-in

Posted in Gulf of Mexico, hurricanes, Offshore Energy - General, tagged Blind Faith, Gulf of Mexico production, Hurricane Ian, Na Kika, Petronius, Thunder Horse on September 27, 2022| Leave a Comment »

Based on current forecasts, Ian’s impact to Gulf of Mexico production facilities should be minimal. However, BP has shut-in Na Kika and Thunder Horse and Chevron has shut-in Petronius and Blind Faith given their more easterly locations.

The Talos-EnVen merger is a pretty big deal

Posted in decommissioning, energy, Gulf of Mexico, Offshore Energy - General, tagged Cognac, Deepwater, EnVen, Gulf of Mexico, merger, Talos on September 26, 2022| Leave a Comment »

Sept 22 (Reuters) – Talos Energy Inc (TALO.N) said on Thursday it will buy EnVen Energy Corp, a private producer in the deepwater U.S. Gulf of Mexico, in a $1.1 billion deal including debt.

As the data below demonstrate, this is a significant merger from a regional perspective. In 2021, the combined company would have been the sixth largest GoM producer of both oil and gas. The two companies are operating 105 platforms, and their 8 deepwater (>1000′) platforms are 14% of the GoM total. Their compliance records, while not at Honor Roll levels, are better than the GoM average based on INCs/inspection. Some major decommissioning projects loom (see the second table below), and the extent to which the merged company is financially prepared for these obligations is unknown. Particularly noteworthy is the Cognac platform, which was the world’s first platform installed in >1000′ of water.

| EnVen | Talos | |

| 2021 Oil (MMbbls) | 9.6 | 17.5 |

| GoM oil rank | 13 | 7 |

| 2022 Gas (Bcf) | 12.6 | 34.8 |

| GoM gas rank | 16 | 9 |

| 2021/2022 well starts | 8 | 8 |

| platforms: total | 14 | 91 |

| platforms >1000′ | 4 | 4 |

| BSEE inspections | 37 | 176 |

| 2022 INCs (W, CSI, FSI) | 12/4/1 | 38/23/10 |

| INCs/inspection | 0.46 | 0.40 |

Decommissioning obligations of note:

| Platform | owner | type | water depth (ft) | installed |

| Amberjack | Talos | fixed | 1100 | 1991 |

| VK 989 | Talos | fixed | 1290 | 1994 |

| Ram Powell | Talos | TLP | 3216 | 1997 |

| GC 18 | Talos | fixed | 750 | 1986 |

| Cognac | EnVen | fixed | 1023 | 1978 |

| Lobster | EnVen | fixed | 775 | 1994 |

| Brutus | EnVen | TLP | 2900 | 2001 |

| Prince | EnVen | TLP | 1500 | 2001 |

Now that the Sale 257 leases have been issued, questions remain

Posted in energy policy, Gulf of Mexico, Offshore Energy - General, tagged BOEM, CCS, Exxon, Lease Sale 257 on September 22, 2022| Leave a Comment »

Which bid was rejected? BOEM announced that 307 of the 308 high bids were accepted. One bid was rejected on fair market value grounds. The unsuccessful bid is not specified on the Sale 257 web page.

When can we expect a statement from Exxon on their intentions for the 94 blocks they acquired? Those 94 blocks (31% of the entire sale) are the elephant in the room, yet we have heard nothing from the company. Given Exxon’s apparent interest in using these leases for CCS purposes, and the tax credits and Federal funding associated with CCS projects (as per the Infrastructure Bill and Inflation Reduction Act), clarification regarding Exxon’s intentions would seem to be appropriate.

Well Control Rule III, IV, or L (depending on which rules you count and how old you are!)

Posted in drilling, Gulf of Mexico, Offshore Energy - General, Regulation, well control incidents, tagged macondo, OCS Order 2, safety record, Well Control Rule on September 20, 2022| Leave a Comment »

Contrary to some post-Macondo commentary, well control has always been the highest priority of the US offshore regulatory program. This was the case regardless of the administration, party in power, responsible bureau, or politics of the day. The first specific well control requirements were in OCS Order No. 2 (Drilling) which dates back to 1958.

Continuous improvement must always be the objective; hence the many revisions to these regulations over the years.

BSEE’s recently proposed Well Control Rule includes updates that should be reviewed by all who are interested in drilling safety and well control regulations. I will be submitting comments to the docket and will post some of those comments on this blog. I hope others take the time to review the relatively brief BSEE proposal and submit comments

Industry comments are typically consolidated which limits the technical discussion and diversity of input. Consensus industry recommendations tend to be less rigorous from a safety perspective than some companies might submit independently. There are also far fewer operating companies than there were in the past. Most of you surely remember Texaco, Gulf, Getty, Amoco, Arco, Mobil, Unocal, and other important offshore operators that have merged into even larger corporations. This further limits the diversity of input.

Of course, the operating company is fully accountable for any safety incident at an OCS facility, including well control disasters like the 1969 Santa Barbara and 2020 Macondo blowouts. This should be ample incentive for comprehensive safety management programs. Unfortunately, risk management, culture, and human/organizational factors are complex, and good intentions don’t always lead to good results.

Although the operating company is legally accountable, the regulator and industry as a whole also bear some responsibility for safety performance. What is the purpose of the regulator if not to prevent safety and environmental incidents? Also, the industry can do better in terms of assessing data, updating standards, and publicly calling out poor performance.

On a more positive note, the offshore industry has collectively had some spectacular well control successes. Perhaps most impressive is this: Prior to 2010, 25,000 wells had been drilled in US Federal waters over the previous 25 years without a single well control fatality, an offshore safety record that was unprecedented in the U.S. and internationally. That number of offshore wells over a 25 year period is by itself a feat that will never again be achieved in any offshore region worldwide. The well control safety record makes that achievement extraordinary.

From the archives: 1983/84 SAFE Award winners

Posted in Gulf of Mexico, Offshore Energy - General, Uncategorized, tagged Lowell Hammons, MMS, offshore safety, SAFE program, SafetyAwardsForExcellence on September 16, 2022| Leave a Comment »

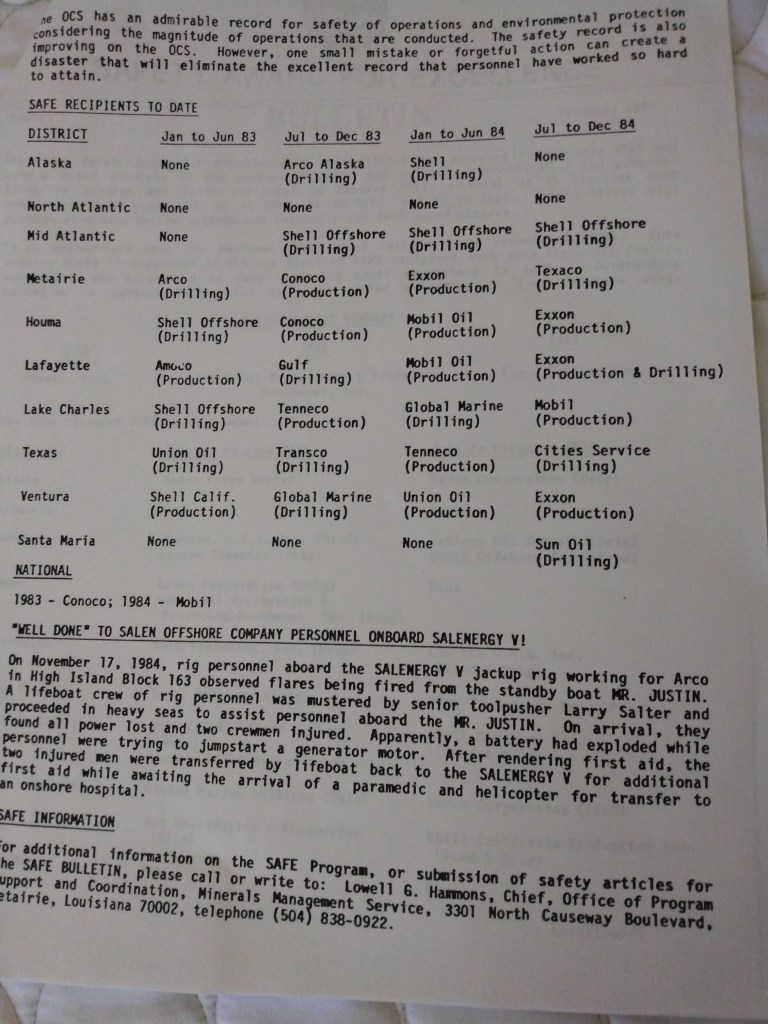

The Safety Award for Excellence (SAFE) program was initiated in 1983 by Lowell Hammons, a senior executive in the Minerals Management Service, the OCS safety regulator at the time. The objective was “to promote interest in and recognition of operational safety and environmental protection on the OCS.” In that regard, the program was highly effective.

Companies could not self-nominate or be nominated by other companies. District winners were selected by MMS district personnel based on compliance and incident data, and inspector evaluations. The national SAFE winner was selected using data and input from all districts. Companies rightfully took great pride in the recognition, and the SAFE program helped drive the development of safety management systems and safety culture initiatives.

Attached is a list of the award winners for 1983 and 1984. Also note the recognition for the Salenergy jackup crew members who rescued injured and endangered personnel from a distressed vessel. Such heroism was not uncommon.

Excerpt from BOEM note on Sale 257

Posted in energy policy, Gulf of Mexico, Offshore Energy - General, tagged BOEM, CCS, FMV, Lease Sale 257 on September 14, 2022| Leave a Comment »

Pursuant to section 50264(b) of the Inflation Reduction Act of 2022 (Pub. L. No. 117-169), Congress has directed BOEM to award leases to the highest valid bidders in Lease Sale 257, which was held on November 17, 2021. Consistent with this direction, BOEM has accepted 307 of the highest valid bids, totaling $189,888,271.

A total of 33 companies participated in the lease sale, generating $191,688,984 in high bids for 308 tracts covering 1.7 million acres in federal waters in the Gulf of Mexico. One bid was rejected for not providing the public with fair market value.

BOEM

Bottom line:

- One bid was rejected on FMV grounds.

- Exxon’s bids on 94 lease blocks adjacent to Texas, that were almost certainly for CCS purposes, were accepted. However, these are oil and gas leases issued as a result of an oil and gas lease sale, and the bids were no doubt evaluated as such. Absent prior oil and gas exploration and development on these leases, or some legal/legislative maneuvering to otherwise convert the leases, CCS operations may not be conducted.

BOEM awarded Sale 257 leases today…

Posted in energy policy, Gulf of Mexico, Offshore Energy - General, tagged BOEM, Lease Sale 257 on September 14, 2022| Leave a Comment »

A full day ahead of the deadline! Waiting for an announcement and details.