Background: On February 12, 2024, the bankruptcy court approved the sale of certain Cox Operating assets to Natural Resources Worldwide LLC (NRW), a company that “does not mine, drill, or produce minerals, has no operations, and conducts business solely in an office environment.”

NRW contracted with Array Petroleum to operate the former Cox Assets. Array subsequently sued NRW, asserting that NRW received $78,000,000 in revenue, but disbursed only about $48,000,000 to pay Array’s invoices and those of the subcontractor.

The court filing claimed that NRW failed to pay Array $2.5 million, the subcontractors $10.7 million, and the United States $12 million. A large share of the subcontractor costs were probably for well operations given that 21 Array workover applications were approved in 2024 and 2025. The $12 million due to the Federal government is reportedly for royalty payments. Were any revenues set aside for decommissioning liabilities?

Array’s lawsuit was dismissed by the court on January 3, 2025, after a joint motion to dismiss was filed by the defendants. Information on the reasons for the dismissal is not publicly available.

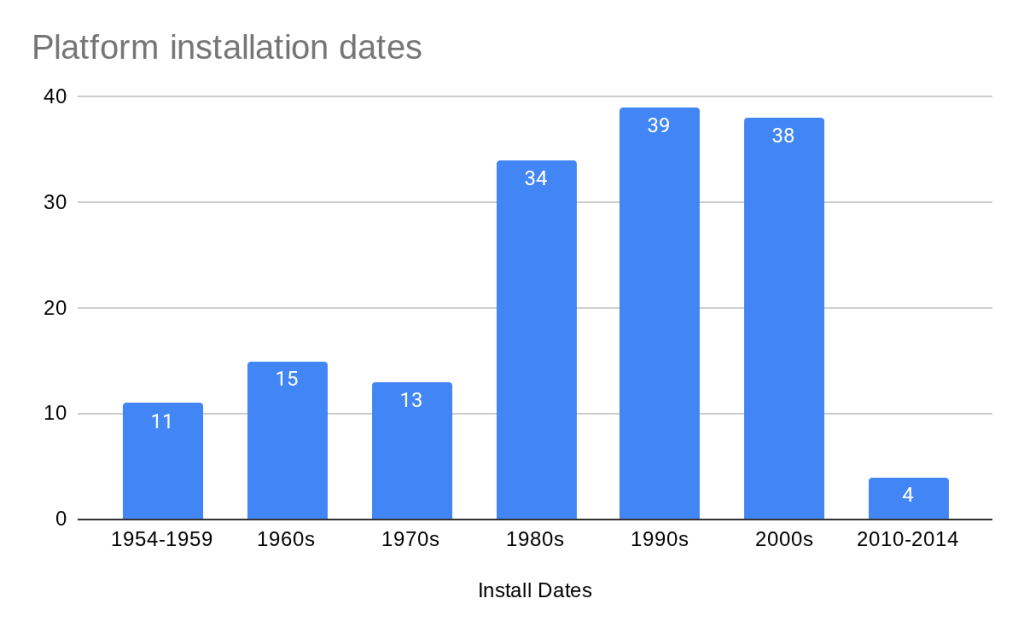

Old platforms: According to BOEM records, Array operates 154 platforms previously owned by Cox. These platforms are in the Ship Shoal, South Marsh Island, and West Delta areas of the Gulf of America. Most are >30 years old and four are more than 70 years old (see chart below). 41 are classified as major structures including 15 of the 26 platforms installed in the 1950s and 1960s. 44 are manned on a 24 hour basis. 79 have helidecks. Massive decommissioning liabilities loom.

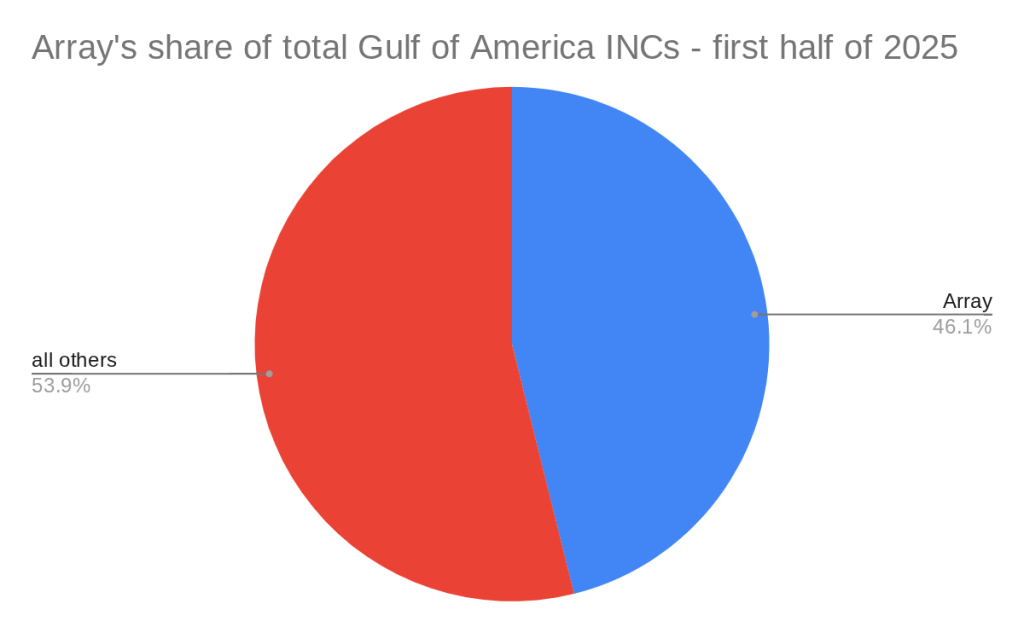

Violations: NRW/Array ranks 37th out of 42 companies in GoA oil production (2025 YTD) and 36th out of 42 companies in gas production, but leads the pack in Incidents of Noncompliance (INCs):

- Array accounted for nearly half of all GoA INCs issued in the first half of 2025 (chart below).

- Array was issued 9 times more warning INCs (311) than any other operator. Apache was second with 34.

- Array had more component shut-in INCS (46) than any other operator. W&T, another operator of Cox legacy platforms, was second with 32.

- Array had more facility shut-in INCs (6) than any other operator. W&T was again second with 5.

- Array averaged 2.0 INCs/facility inspection vs. a combined average of 0.3 INCs/facility inspection for all other operators.

| violation type | warnings | component shut-ins | facility shut-ins |

| Array | 311 | 46 | 6 |

| all others | 211 | 164 | 49 |

Lessons that should have been learned from the Cox, Fieldwood, Black Elk, Signal Hill, and other bankruptcies dating back to the Alliance Operating Corp. failure in 1989:

- There are many small and mid-sized companies that are responsible operators. Their participation in the OCS program should be encouraged. However, others have demonstrated, by their inattention to financial and safety requirements, that they are not fit to operate OCS facilities.

- The growth of Fieldwood, Cox, Signal Hill, and Black Elk was in part facilitated by lax lease assignment and financial assurance policies.

- Operating companies should have to demonstrate that they can operate safety and comply with the regulations before they are approved to acquire more properties.

- Despite ample evidence of the importance of compliance and safety performance in determining the need for supplemental financial assurance, BOEM’s 2024 rule dropped all consideration of these factors.,

- Expect the ultimate public cost of the Cox bankruptcy, in terms of decommissioning liabilities and the need for increased oversight, to be large.

- The Federal govt (Justice/Interior) should strongly oppose bankruptcy court asset sales that increase public financial, safety, and environmental risks.