Attached are PHMSA’s Christmas week Emergency Special Permit and Permit Analysis document. Is the path clear to restart SYU production before New Year’s day?

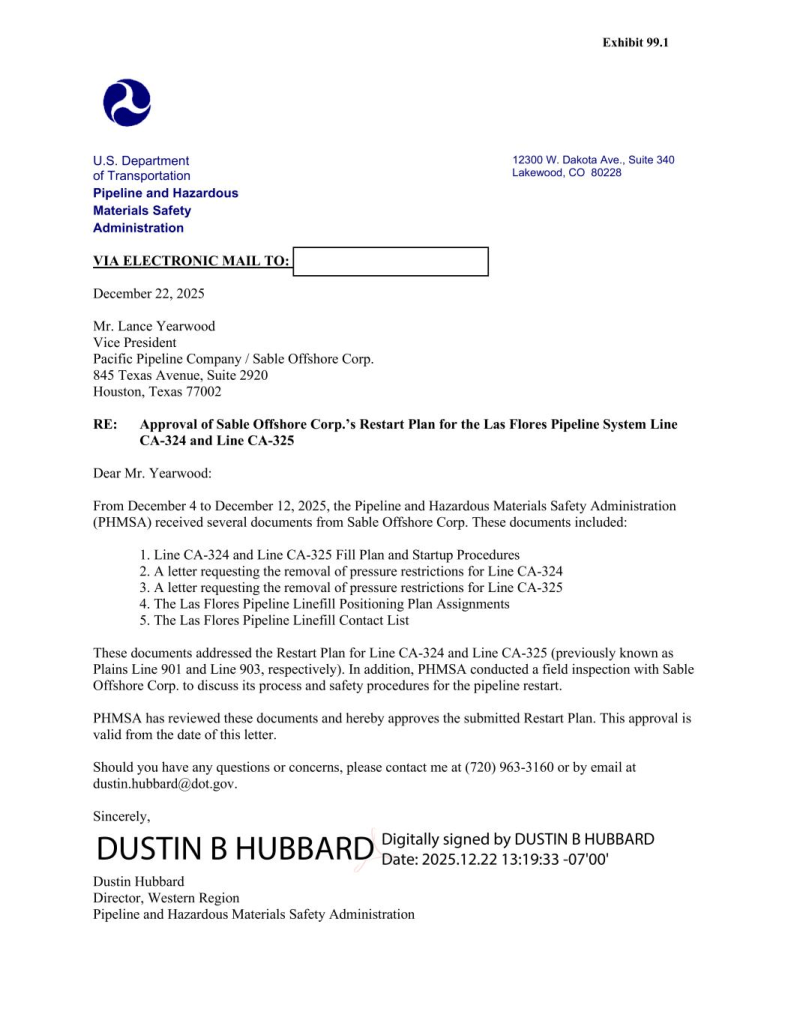

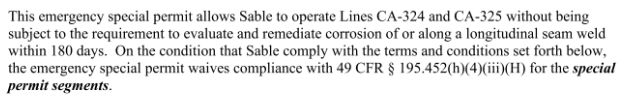

Three excerpts from the first attachment are pasted below. The last paragraph on p. 2 succinctly explains PHMSA’a emergency permit:

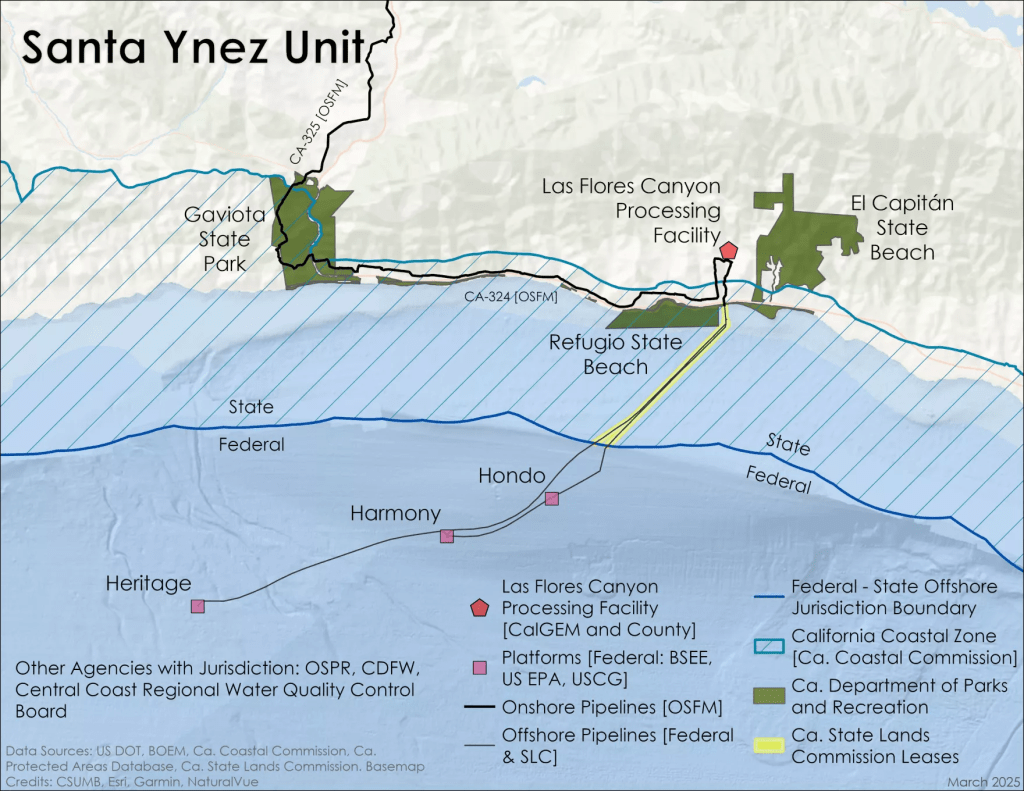

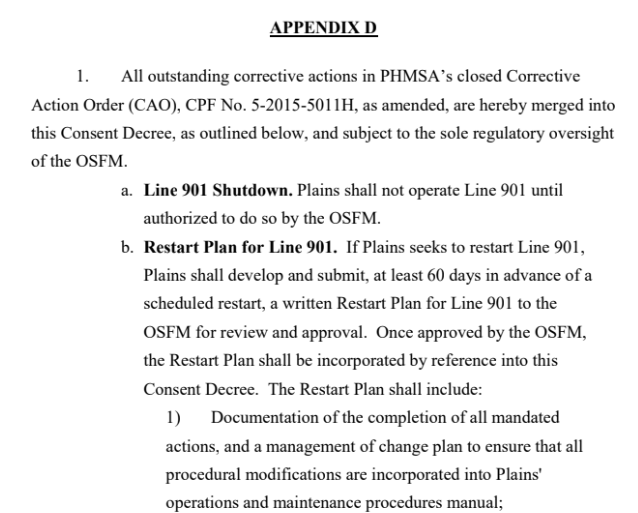

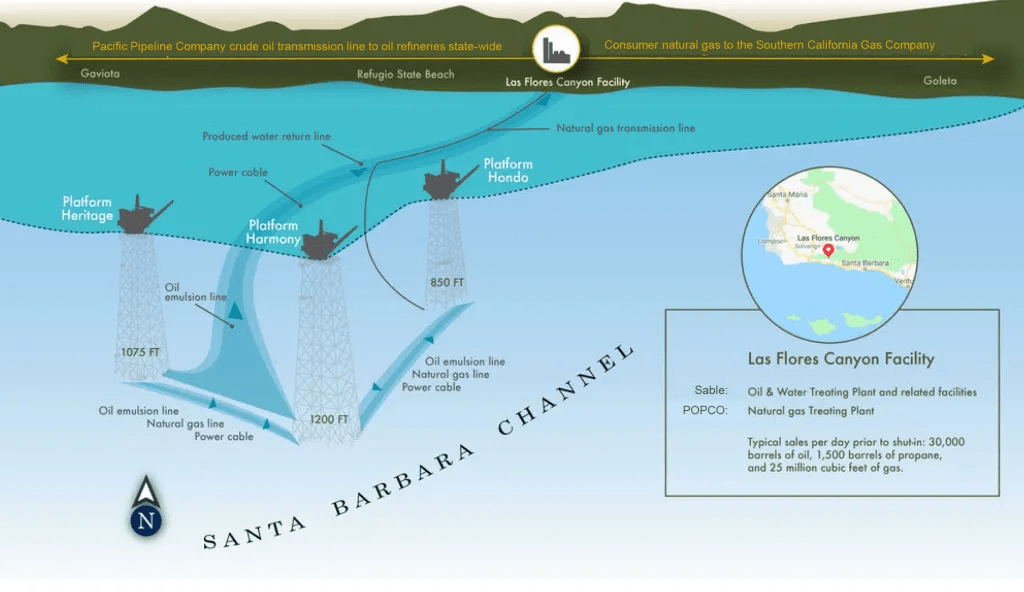

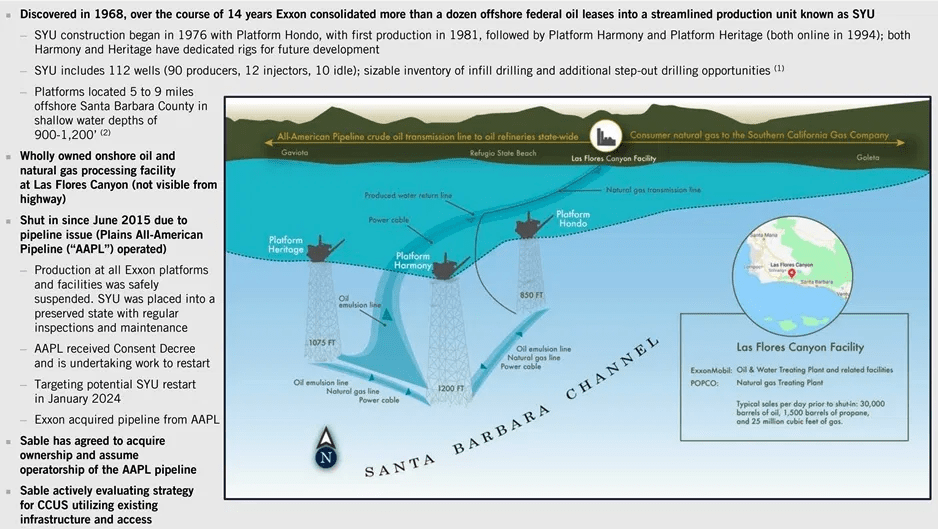

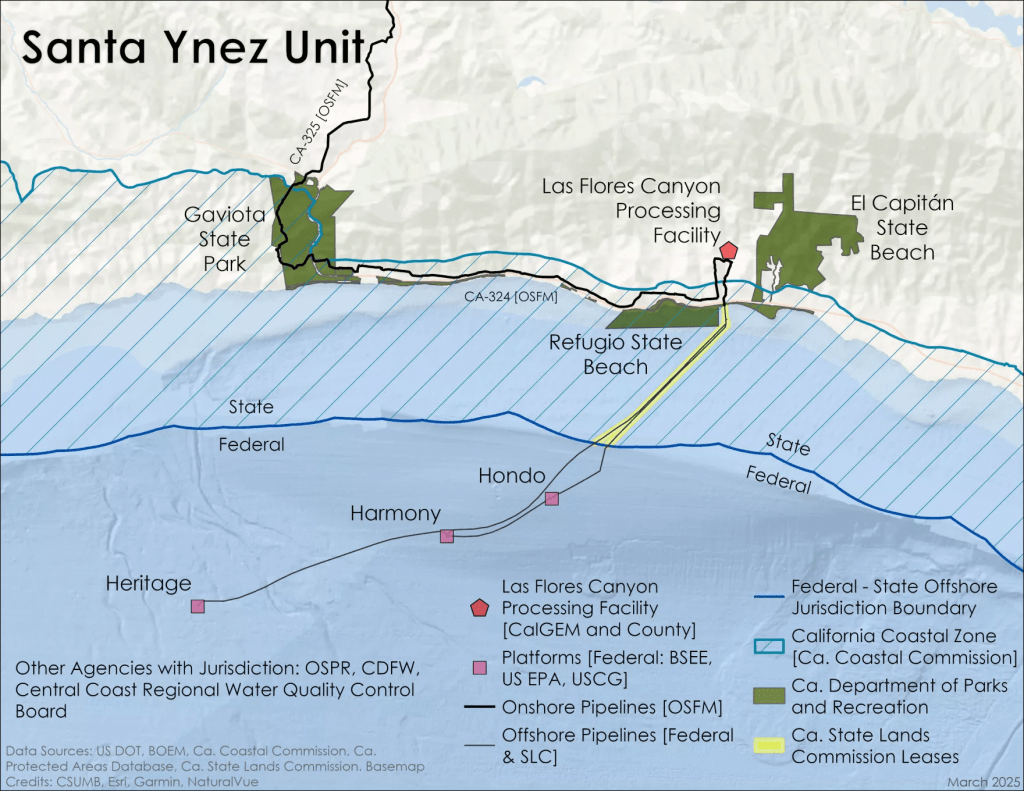

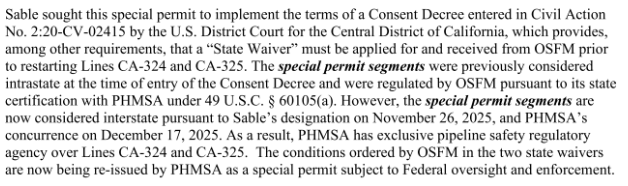

PHMSA was able to assume jurisdiction from the State because the pipeline transports Federal OCS oil and is thus inherently interstate. The perceived problem with a PHMSA takeover had been the court approved Consent Decree that was executed following the 2015 Refugio pipeline spill. That Decree specifies that the State Fire Marshal must approve a restart of the pipeline. The first paragraph on p. 2 of the permit explains PHMSA’s position that the Consent Decree has been superseded.

The provision pasted below (p. 4 of the permit) seems contradictory in that it stipulates compliance with the Consent Decree. However, PHMSA apparently sees no contradiction in that references to the Fire Marshal (OSFM) should now be read as references to PHMSA. PHMSA presumably included this provision to reaffirm the need to comply with the technical requirements in the Decree.

The second attachment is PHMSA’s analysis of the special permit. Note that the permit expires in 60 days. Public notice and opportunity for comment would be required for a renewal.

Environmental organizations reacted quickly to the PHMSA permit, filing an emergency motion in the 9th circuit (third attachment). Observations:

- Impressive effort given the time crunch. The PHMSA permit was issued on 12/23, just 3 days prior to the court filing. No Christmas break for those folks!

- If you wonder why the petition was filed with the 9th Circuit (seemed convenient given the 9th Circuit’s reputation), a filing at the Circuit level is required for appeals of PHMSA orders.

- Petitioners strongest argument: Sable is not entitled to emergency relief, as there is no real emergency. PHMSA asserts that EO 14156, which declared a National Energy Emergency, supports the emergency permit.

- The petitioners environmental doom prediction is not compelling. PHMSA’s position is that the mitigations they are imposing (reduced operating pressure, inline inspections, testing and sampling, etc) provide protection equal to or greater than than the corrosion remediation requirement that is being waived.

- The petitioners asked the Court for relief no later than 12/26. That date has passed. Will there be a ruling today?

Barring an injunction, odds are that Sable restarts production prior to New Year’s Day, when a requirement (SB 237) for a new Coastal Development Plan, takes effect.