This deer was encountered 1.5 miles offshore during a fishing trip. The deer was brought to shore and released. Happy ending!

Posted in Gulf of Mexico, rigs-to-reefs, Uncategorized, tagged Gulf of Mexico, offshore deer, rigs-to-reefs on August 19, 2022| Leave a Comment »

Posted in climate, energy policy, Gulf of Mexico, Offshore Energy - General, tagged flaring, Inflation Reduction Act, Lease Sale 257, offshore oil, Offshore Wind on August 15, 2022| Leave a Comment »

Posted in accidents, Gulf of Mexico, Offshore Energy - General, pipelines, tagged Gulf of Mexico oil production, Mars pipeline, Shell on August 13, 2022| Leave a Comment »

Posted in accidents, Gulf of Mexico, Offshore Energy - General, pipelines, tagged Chevron, Equinor, Gulf of Mexico production, Mars, Olympus, Shell pipeline, Ursa on August 12, 2022| Leave a Comment »

But late Thursday, a Shell spokesperson said that repairs were underway and that the company expected both pipelines to be back in service Friday.

CNN

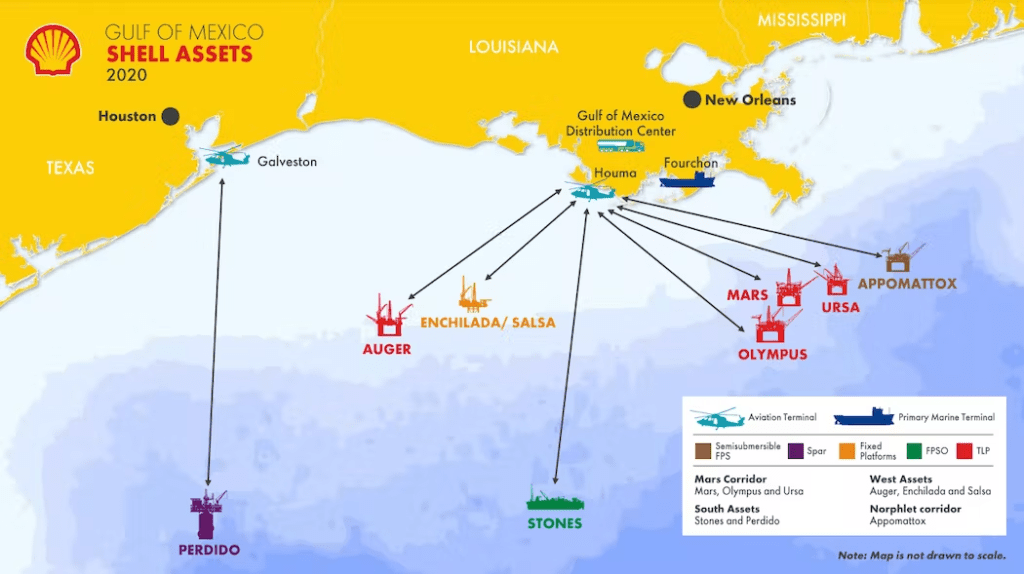

This is a good example of the interconnectivity of deepwater projects with major Shell, Chevron, and Equinor facilities shut-in as a result of a relatively minor downstream pipeline incident.

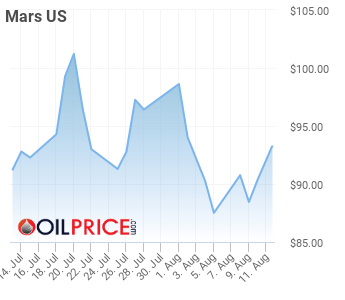

Mars crude price appears to have reacted to the shut-in news:

Posted in accidents, Gulf of Mexico, Offshore Energy - General, tagged Gulf of Mexico, Mars, Olympus, pipeline, production shut-in, Shell, Ursa on August 11, 2022| Leave a Comment »

A small pipeline leak (estimated 2 bbl spill) at an onshore booster station is having a major impact on Gulf of Mexico production. Per Reuters, as much as 600,000 bopd could be temporarily shut-in. GoM production averaged 1.6 million bopd in May.

These major platforms are reported to be shut-in:

Shell, the pipeline operator, did not provide an estimate on the resumption of production.

Posted in CCS, energy policy, Gulf of Mexico, Offshore Energy - General, tagged Lease Sale 257, Manchin, Schumer on August 7, 2022| 1 Comment »

Tucked into the end of the nearly $370 billion deal struck last week by Senate Majority Leader Chuck Schumer (D-N.Y.) and Senate Energy and Natural Resources Chair Joe Manchin (D-W.Va.) is a requirement for the Interior Department to reinstate a massive 80 million-acre Gulf of Mexico lease sale that a federal judge blocked earlier this year for violating NEPA.

E&E News

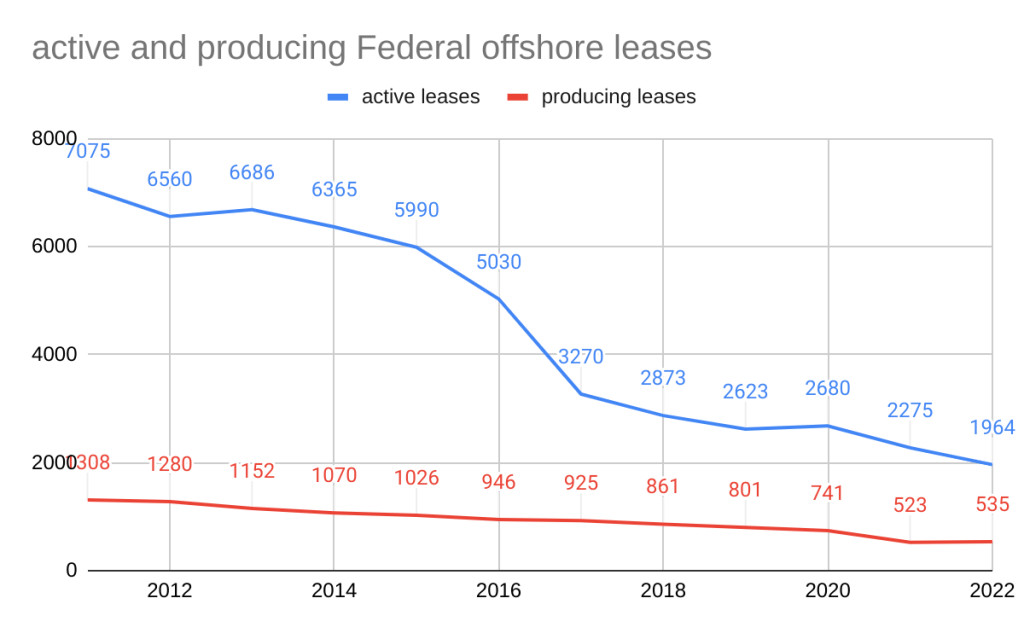

Tracts covering 1.7 million acres received bids at Lease Sale 257. 30.5% of those tracts received bids for CCS purposes, leaving about 1.2 million acres receiving bids for oil and gas exploration. Nonetheless, some continue to distort the magnitude of this rather ordinary lease sale. It’s also important to note that the number of active US offshore leases has declined by 72% since 2011, and is now under 2000 for the first time in decades.

Posted in energy policy, Gulf of Mexico, Offshore Energy - General, tagged BHP, East Breaks, Hoodoo, Lease Sale 257, Westwood on August 5, 2022| Leave a Comment »

Westwood has highlighted 13 wells planned for the remainder of 2022 as ‘key wells to watch’. These include a number of frontier play tests, for example Raia offshore Mozambique, and Pensacola, offshore UK; extensions of proven plays, including Zanderij offshore Suriname and Hoodoo, US Gulf of Mexico; and large prospects in proven plays, such as Wei, offshore Guyana.

Westwood

The Hoodoo prospect cited by Westwood is operated by BHP and is in East Breaks Blocks 699 and 700. At Sale 257 (11/17/2021), BHP was the sole bidder on 4 blocks just to the north of this prospect. The lease sale was vacated by a Federal judge in January. If the vacature of Sale 257 is not reversed, either by appeal or legislation, one or both of the following outcomes could easily occur:

Either outcome would be unfair to BHP and would discourage investment in OCS exploration and development.

Posted in Gulf of Mexico, Offshore Energy - General, tagged 75 years, drilling, Gulf of Mexico, leasing, production on August 3, 2022| Leave a Comment »

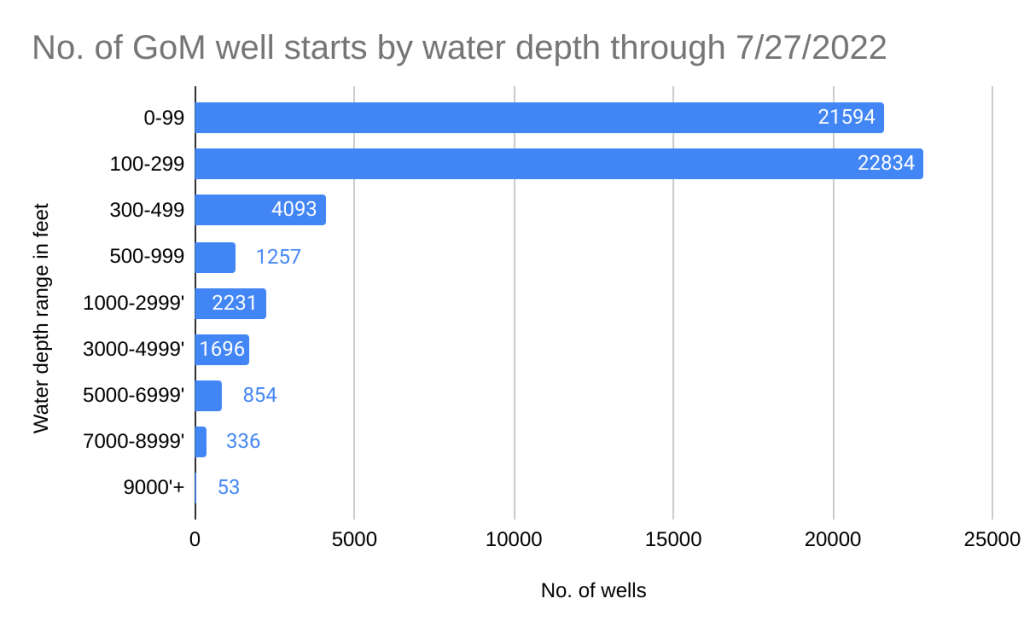

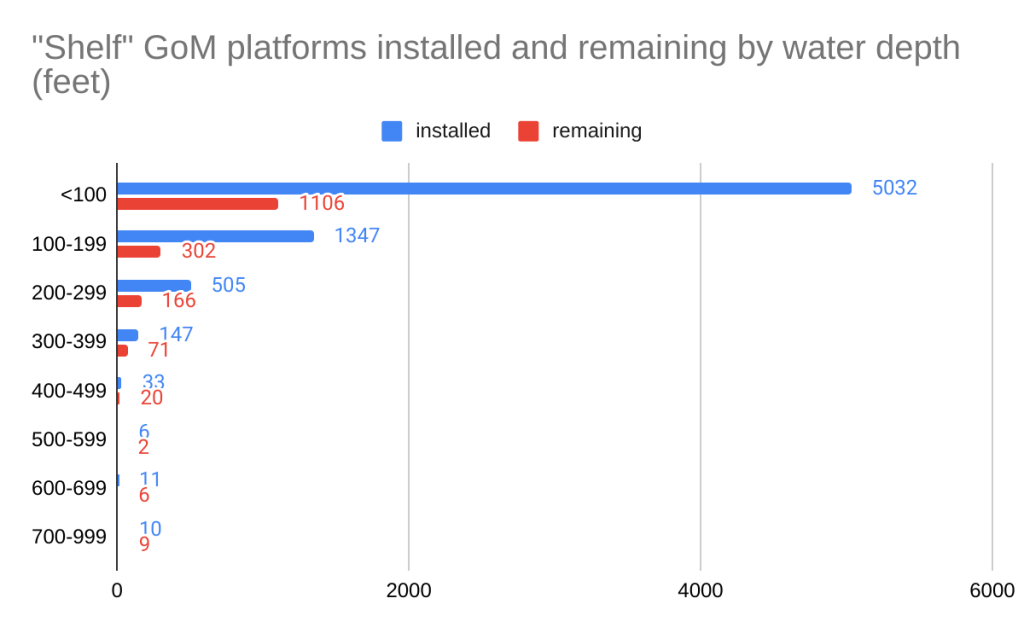

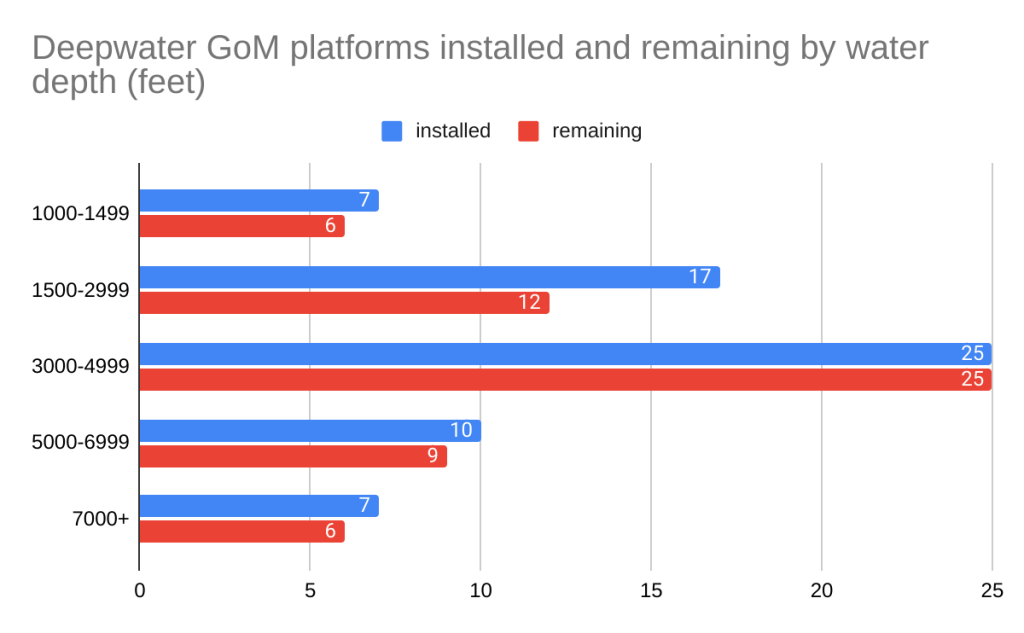

Per our post on the first Gulf of Mexico OCS production, here is what has happened since:

Except for the GAO pipeline estimate, all numbers are from BSEE and BOEM online data centers.

Posted in CCS, energy policy, Gulf of Mexico, Offshore Energy - General, tagged carbon sequestration, CCS, Exxon, infrastructure bill, Lease Sale 257, Manchin, Schumer on August 2, 2022| Leave a Comment »

The subject legislation requires the Secretary of the Interior to accept the highest valid bid that was received for each tract offered in OCS Lease Sale 257. Exxon was the sole bidder on 94 tracts on the nearshore Texas shelf. The leases were to be acquired for carbon sequestration purposes.

The CCS bids should not be considered valid given that:

Unexpectedly, the Infrastructure Bill, signed on 11/15/2021 (just 2 days before Sale 257) included a provision for OCS carbon sequestration. However, that legislation did not require CCS leasing or authorize DOI to sell CCS leases as part of an oil and gas lease sale; nor did it exempt DOI from complying with its leasing regulations. Instead, It gave the Secretary a year (until 11/15/2022) to promulgate necessary implementing regulations. If carbon sequestration in the Gulf of Mexico is deemed to be desirable, a separate CCS sale should be held when the regulatory framework has been established.

Posted in climate, energy policy, Gulf of Mexico, Offshore Energy - General, Wind Energy, tagged Manchin, offshore oil, Offshore Wind, Schumer on August 1, 2022| Leave a Comment »

When we (MMS) drafted the OCSLA amendments (incorporated into the Energy Policy Act of 2005) that authorized offshore wind operations, we envisioned complementary and synergistic programs. Offshore wind and oil/gas development have many similarities and a common purpose – energy production. There is considerable overlap among the operating companies and contractors.

Unfortunately, politicians are better at dividing than uniting, and a provision in the Schumer-Manchin legislation pits the offshore wind and oil/gas programs against each other. The text (pasted below) from p. 646 of the bill restricts wind leasing when no oil and gas lease sale has been held in the prior year.

I share the concerns about the OCS program evolving into a wind-only program, as has already happened in the Atlantic (more on this at a later date). However, oil and gas sales should be held because they make economic and environmental sense, not because they are a condition for holding wind sales. Oil and gas sales are not punishment and wind sales are not rewards, and holding a single GoM lease sale each year does not balance the offshore program.

(b) LIMITATION ON ISSUANCE OF CERTAIN LEASES OR RIGHTS-OF-WAY.—During the 10-year period beginning on the date of enactment of this Act—

(2) the Secretary may not issue a lease for offshore wind development under section 8(p)(1)(C) of the Outer Continental Shelf Lands Act (43 U.S.C.1337(p)(1)(C)) unless—

(A) an offshore lease sale has been held during the 1-year period ending on the date of the issuance of the lease for offshore wind development; and (B) the sum total of acres offered for lease in offshore lease sales during the 1-year period ending on the date of the issuance of the lease for offshore wind development is not less than 60,000,000 acres.