Can we dedicate the victory to the Iranian “journalist” who aggressively questioned Tyler Adams yesterday (see clip below)? Great response from Tyler who is nothing but class on and off the field. A great captain.

Archive for 2022

Iran 0 USA 1

Posted in Uncategorized, tagged Iran, Tyler Adams, USA, World Cup on November 29, 2022| Leave a Comment »

More White House briefing humor

Posted in energy policy, Uncategorized, tagged 9000 permits, undrilled leases, venezuela, White House on November 29, 2022| Leave a Comment »

Q Does the President think there’s some benefit to the climate to drill oil in Venezuela and not here?

MR. KIRBY: No, it has nothing to do with a benefit to the climate, Peter. Again, there are 9,000 unused permits here in the United States on federal land that oil and gas companies can and should take advantage of. Nine thousand. And we’re talking about one there in Venezuela.

Oh no, not the 9000 permits response yet again!

Can someone please help the White House staff understand the difference between leases and permits, and the process that is followed in exploring for and producing oil and gas? Perhaps this will help.

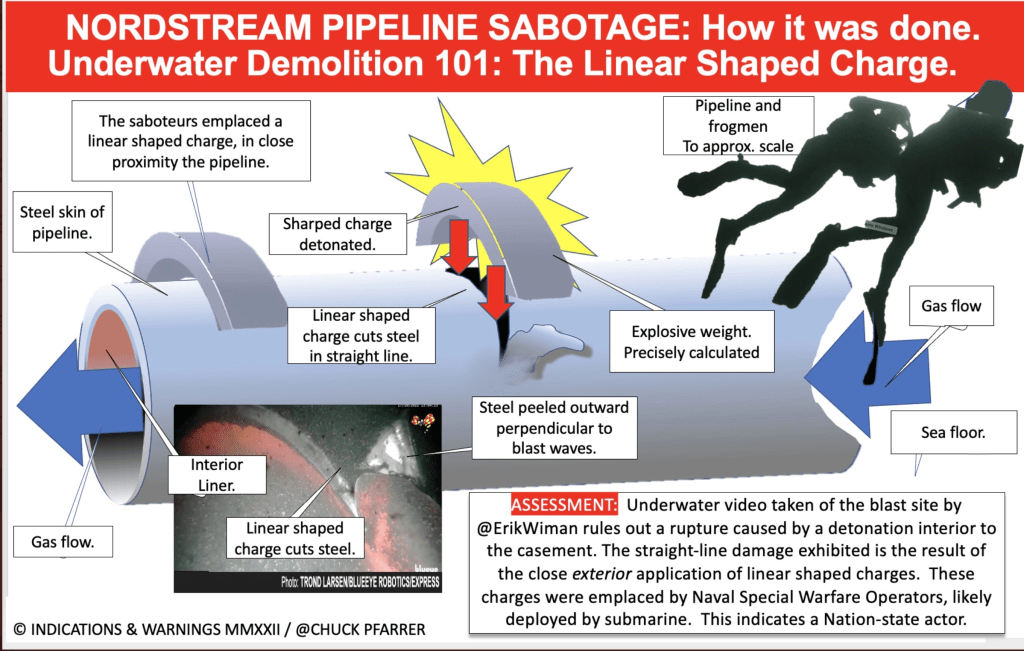

This Nord Stream scenario is credible, but the big question is “who,” not “how”

Posted in Offshore Energy - General, pipelines, Russia, tagged explosions, Nord Stream, pipelines, who did it? on November 28, 2022| Leave a Comment »

Wisdom

Posted in Uncategorized, tagged Richard Feynman, wisdom on November 25, 2022| Leave a Comment »

On Thanksgiving …

Posted in Uncategorized, tagged Thanksgiving on November 24, 2022| Leave a Comment »

Well Control Rule commenters

Posted in Offshore Energy - General, Regulation, well control incidents, tagged BSEE, commenters, Well Control Rule on November 22, 2022| Leave a Comment »

Per Regulations.gov. BSEE received 30 comments on the proposed revisions to the Well Control Rule, 25 of which have been posted. The other comments were presumably deemed inappropriate for posting per the guidance at Regulations.gov.

Two of the responses were submitted collectively by 8 industry trade associations. Only 3 operating companies commented and their comments largely echoed the trade association responses. Only 2 drilling contractors responded independently. Four service and engineering companies commented.

Three environmental organizations, a group of Atlantic states, a government watchdog, and a law school provided comments.

Three individuals and 4 anonymous or unknown parties commented.

Below is a list of the respondents preceded by their comment identifiers. More to follow.

- 0003 Foley Engineering

- 0004 Frank Adamek

- 0005 Anonymous

- 0006 Project on Government Oversight (POGO)

- 0007 E.P. Danenberger

- 0008 Chevron

- 0009 B. Mercier

- 0010 Anonymous

- 0011 Anonymous

- 0012 Foley Engineering (2nd comment)

- 0013 HMH (?)

- 0014 NYU School of Law

- 0015 Beacon Offshore

- 0016 Shell

- 0017 Diamond Offshore

- 0018 7 industry trade associations: API, IADC, IPAA, NOIA, OOC, EWTC, USOGA

- 0019 NOV (service company)

- 0020 NRDC

- 0021 Oceana

- 0022 Transocean

- 0023 Louisiana Mid-Continent Oil & Gas Association

- 0024 Kinetic Pressure Control Limited

- 0025 Attorneys General of Maryland, Connecticut, Maine, Massachusetts, New York, and North Carolina

- 0026 Ocean Conservancy

- 0027 Rigscope International

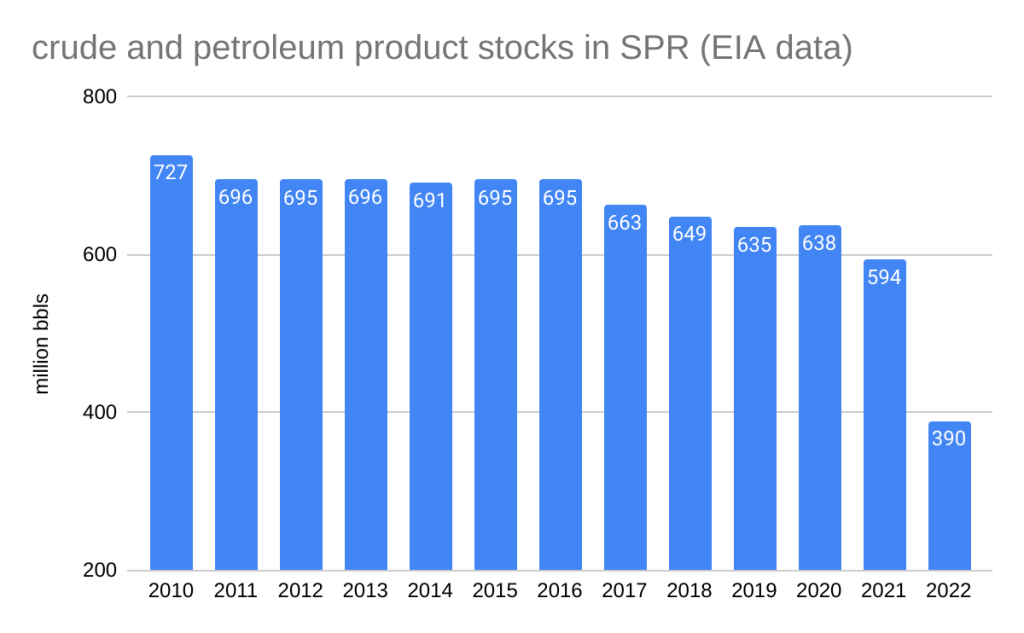

SPR declines to 390.5 million bbls (11/18/2022). When does it end?

Posted in energy policy, tagged SPR depletion, Strategic Petroleum Reserve on November 22, 2022| 1 Comment »

Which Sale 257 bid was rejected?

Posted in CCS, Gulf of Mexico, Offshore Energy - General, tagged BHP, CCS, Gulf of Mexico, Lease Sale 257, rejected bid on November 21, 2022| Leave a Comment »

On September 14, 2022, BOEM announced that 307 high bids from Lease Sale 257 in the Gulf of Mexico were accepted. BOEM also announced that one high bid was rejected for not providing the public with fair market value. BOEM has not identified the rejected bid.

Per BOEM’s Lease Area Block Online Query file, 306 Sale 257 leases were effective on Oct. 1, 2022. A comparison of these data with the sale results identified 2 Sale 257 leases that have not been awarded:

| lease | block | high bidder(s) | bid | comments |

| G37261 | GC 70 | BHP | $3.6 million | lone bid; 7th highest bid in sale |

| G37294 | GC 777 | BP (75%), Talos (25%) | $1.8 million | 2 bids; next highest $1.185 million |

So one of these 2 bids was rejected and the other has lease not yet been awarded for some reason (or perhaps there has been a clerical/IT issue).

Which bid was rejected? I would guess it was the BHP bid even though that bid was the 7th highest bid in the entire sale. The fact that this bid was $2.5 to $3 million higher than the other 7 BHP bids (all of which were accepted) tells us that the company valued this tract highly. Perhaps BOEM, which has all of the geologic data, thought the value was even higher, which is why the bid may have been rejected.

There was another bidder (Chevron) for the BP/Talos tract, so the competition makes it less likely that the bid would have been rejected.

Ironically, the 94 carbon sequestration bids, which made something of a mockery of the lease sale, could not be rejected on fair market grounds. The bids exceeded the minimum required, and the tracts have little or no value from an oil and gas production standpoint. A competitive process would be require to repurpose these leases for carbon sequestration.

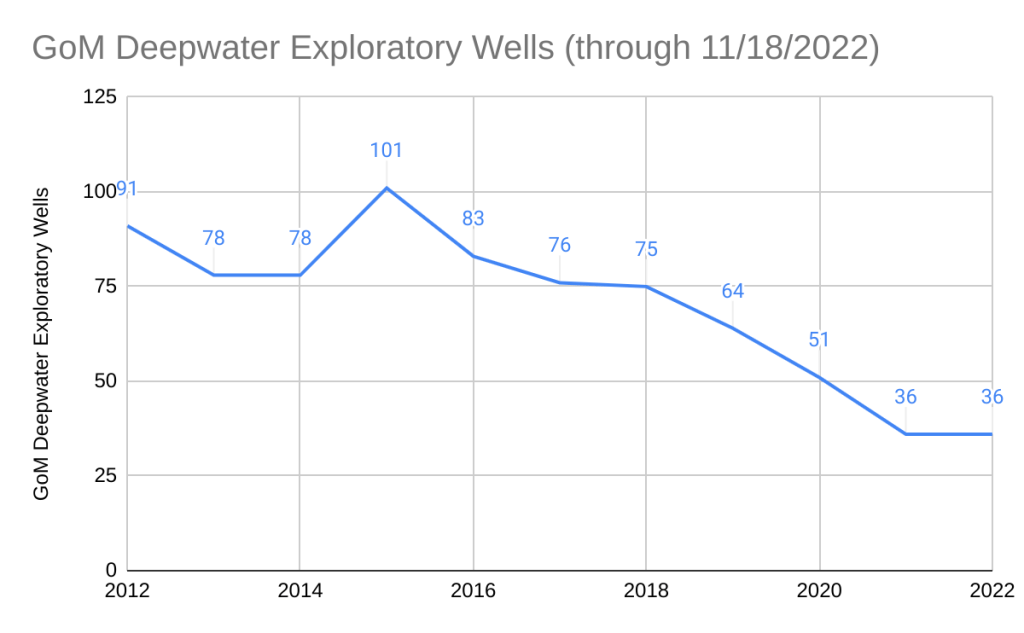

Stemming the decline in deepwater Gulf of Mexico exploration?

Posted in Gulf of Mexico, Offshore Energy - General, tagged bp, Chevron, ConocoPhillips, deepwater exploration, Exxon, Gulf of Mexico, Hess, LLOG, Murphy, Shell, Talos, Woodside on November 18, 2022| Leave a Comment »

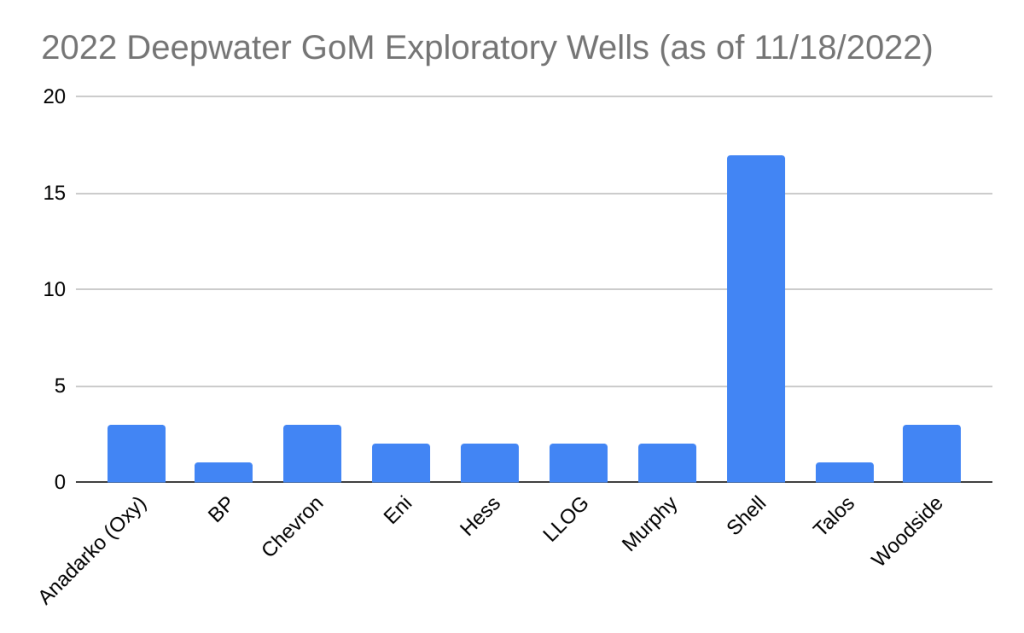

Was 2021 the low point? Hopefully that is the case, but consistent leasing is essential.

Looks like Woodside is now officially the GoM operator of record (was BHP prior to merger). Kudos to them.

Shell continues to be the GoM bellwether. There is no OCS program without them.

What’s up with BP and Chevron? Big declines from both.

US super-majors Exxon and ConocoPhillips remain out of the picture, both in terms of lease acquisition and exploration. Disappointing.

Tip of the hat to Hess, LLOG, Murphy, and Talos – independents committed to deepwater production.

OK, but what do you think about the revisions to the Well Control Rule? 😀

Posted in Offshore Energy - General, Regulation, well control incidents, tagged BSEE Director, comments, Well Control Rule on November 23, 2022| Leave a Comment »

Diverse input on proposed regulations is healthy and desirable. However, comments should not be posted at Regulations.gov unless (1) the commenter is identified and (2) the comments include at least one sentence about the regulation being proposed.

Read Full Post »