A Metairie-based oil company that’s one of the largest independent operators still working in the state’s shallow coastal waters has filed for bankruptcy protection, leaving dozens of south Louisiana service and supply companies facing potential bankruptcies of their own.

Bankruptcy court documents show Cox’s estimated liabilities are close to $500 million – more than $200 million of which is owed to small businesses in the Houma-Thibodeaux and Acadiana areas.

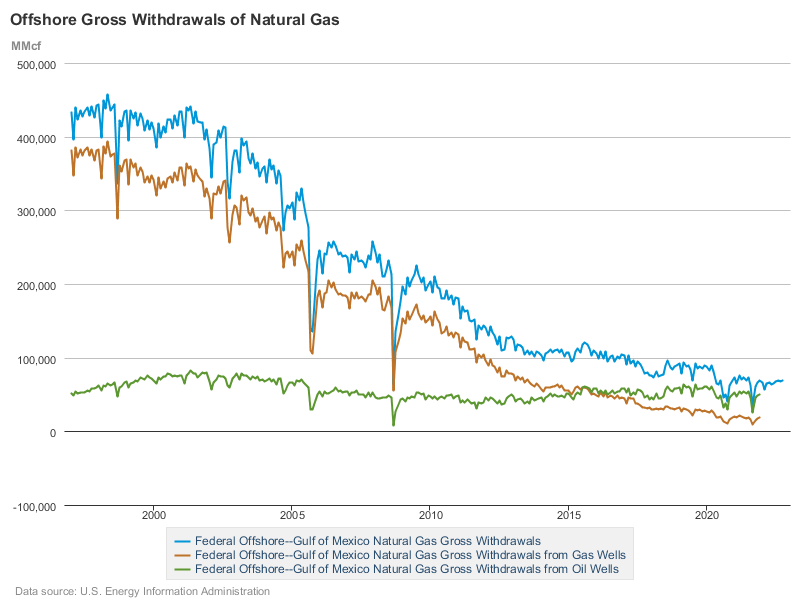

Court documents indicate that Cox followed a path that led to financial trouble for other companies in recent years: using debt to acquire large fields of aging wells in shallow Gulf waters.

Nola.com

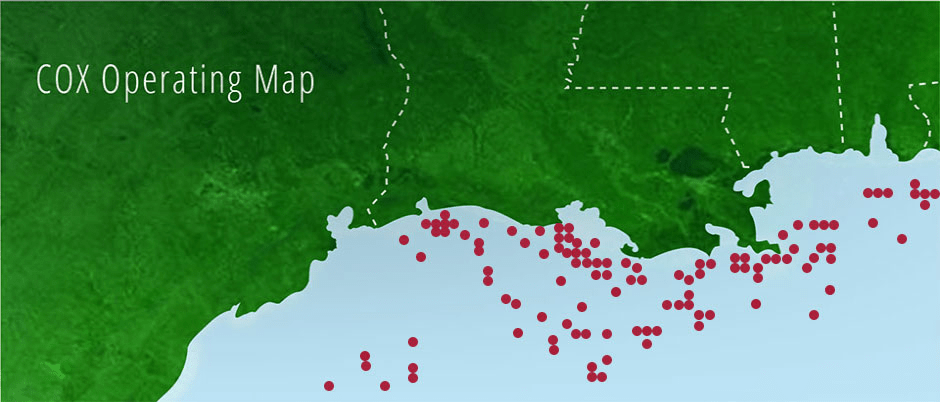

This blog is primarily concerned with the potential impacts of the bankruptcy on safety performance, the plugging of wells, and the decommissioning of old facilities. Per BOEM’s data base, Cox currently operates 276 Gulf of Mexico platforms, all in shallow shelf waters. The company is reported (Nola.com) to owe $8 million in bond premiums needed to support well plugging operations.

Cox has not been an active driller of late with only 2 well starts since 1/1/2022 (BSEE borehole file).

Cox has been a major generator of INCs (incidents of noncompliance) with 437 INCs YTD. Cox has been responsible for 47% of all GoM INCs in 2023. Cox’s INC to inspection ratio was 2.46 vs. a combined ratio of 0.50 (490/972) for all other GoM operators.

Cox is currently ranked 11th and 18th respectively in GoM gas and oil production with 7.2 billion cu ft and 1.8 million barrels produced YTD.

BOE previously commented on Cox’s pursuit of Dept. of Energy funds to develop a carbon sequestration hub in the Gulf.