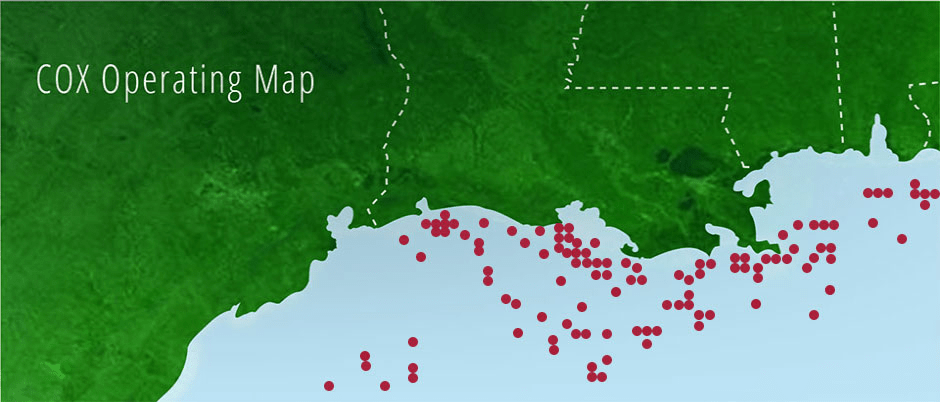

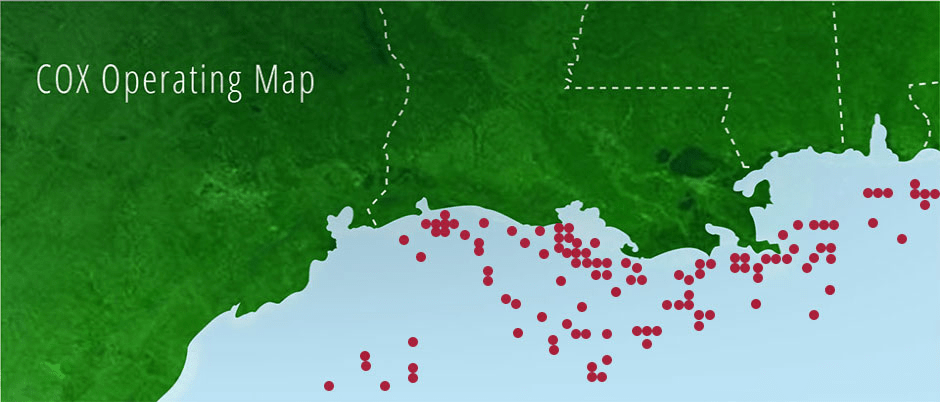

Cox Operating LLC and affiliates were once again the violations leaders in 2024 accounting for 50% (479/957) of the warnings, 12% (47/398) of the component shut-ins, and 7.3% (8/109) of the facility shut-ins.

All but 3 of the Cox enforcement actions were during the first half of the year. This is presumably because of the termination of Cox operations and the ongoing divestiture of their assets.

According to BOEM’s platform data base, Cox (43) and affiliates Energy XXI (3) and EPL (0) now operate only 46 platforms. This is a big decline from Sept. 2024 and June 2023 when the Cox companies operated 243 and 435 platforms respectively. All of the remaining Cox platforms are non-producing and are on relinquished or terminated leases.

The curtailment of Cox operations is no doubt an important factor in the sharp decline in Gulf of America violations in the second half of 2024. Per the data below, total GoA wide violations declined by 58% (1031 vs. 433) in the second half of 2024 as Cox violations essentially disappeared:

| Gulf of America inspection data | warnings | component shut-ins | facility shut-ins | facility inspections |

| first half 2024 | 725 | 243 | 63 | 1586 |

| 2nd half 2024 | 232 | 155 | 46 | 1546 |

| reduction | 493 (68%) | 88 (36%) | 17 (27%) | 40 (2.5%) |

| Cox companies inspection data | warnings | component shut-ins | facility shut-ins | facility inspections |

| first half 2024 | 478 | 46 | 7 | 404 |

| 2nd half 2024 | 1 | 1 | 1 | 174 |

Some Cox assets have been acquired by W&T and Natural Resources Worldwide. BOEM records indicate that 8 record title assignments and 3 operating rights assignments from Cox to W&T were approved in the first half of 2024. W&T currently operates 116 platforms, but it’s unclear how many are former Cox facilities.

The acquisition of Cox properties does not appear to have significantly affected W&T 2024 inspection results, which were respectable:

| W&T insp. data | warnings | component shut-ins | facility shut-ins | facility inspections |

| first half 2024 | 12 | 31 | 0 | 83 |

| 2nd half 2024 | 17 | 14 | 2 | 105 |

Additional record title and operating rights assignments to Natural Resources Worldwide (NRW) were approved in 2025, but NRW does not appear to be operating any platforms.

Ironically, NRW was cited for 1 warning and 1 facility shut-in without a single inspection. Presumably, these violations were the result of administrative issues.

Online data are insufficient to account for the 435 platforms that were on the Cox ledger in June 2023 or determine the remaining decommissioning liabilities. Per the platform database, no Cox, Energy XXI, or EPL platforms were removed in 2023, 2024, or 2025.

On a more positive note, most GoA operators had good safety and compliance records in 2024. One major producer had a historically significant record. More on that to follow.