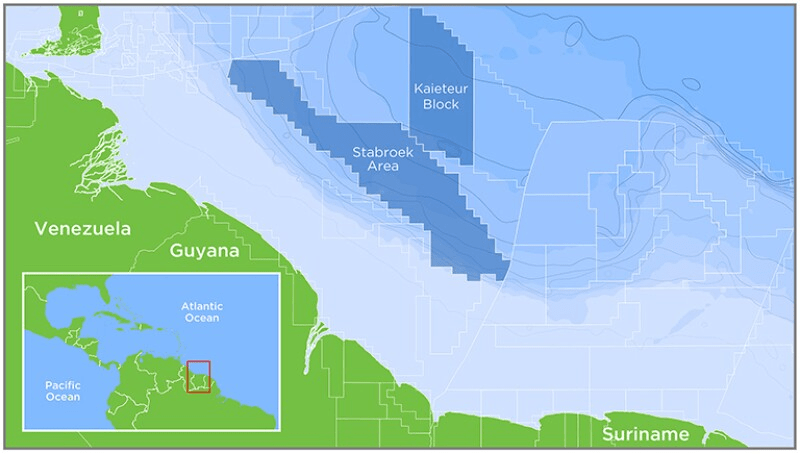

Are Exxon and Chinese partner (CNOOC) attempting to use Chevron’s acquisition of Hess to improve their already lucrative position in Guyana’s prolific Stabroek block?

From OilNow Guyana:

- The Stabroek operating agreement outlines terms for Hess, Exxon, and CNOOC to explore and develop the block.

- This Stabroek agreement includes a right of first refusal (ROFR) provision which allows the parties to buy out the stake of one of them in the event of a ‘change of control’ transaction.

- Chevron and Hess argue that the merger’s structure does not trigger the ROFR clause.

- Exxon and CNOOC argue that the clause applies. This could force Hess to offer its stake in the Stabroek block to its partners first.

The Exxon/CNOOC position seems to be a stretch. Chevron did not buy the Stabroek share; they bought the company that holds that share. Hess is to be part of Chevron and there would be no change of control from the standpoint of the partnership.

As an offshore operator, Exxon has been highly responsible from a safety standpoint. However, the company has a shown tendency to stretch the envelope when it comes to contract rights. The most recent example was their acquisition of 163 GoM oil and gas leases for carbon disposal purposes, contrary to the terms of the sale notice and lease contracts.