Excerpts from a stunning Sable update issued by Hunterbrook Media LLC (“Hunterbrook“) on November 14, 2025:

- SEC filing reveals Sable entered October about a month from potential bankruptcy. The company had $41.6 million as of September 30, with $39.7 million in average monthly burn in 3Q25.

- When Sable announced its $250 million financing on November 10 at $5.50 per share, the company likely had single digit millions in the bank based on its reported burn, against over $163 million in accounts payable and accrued liabilities. Sable does not generate any revenue.

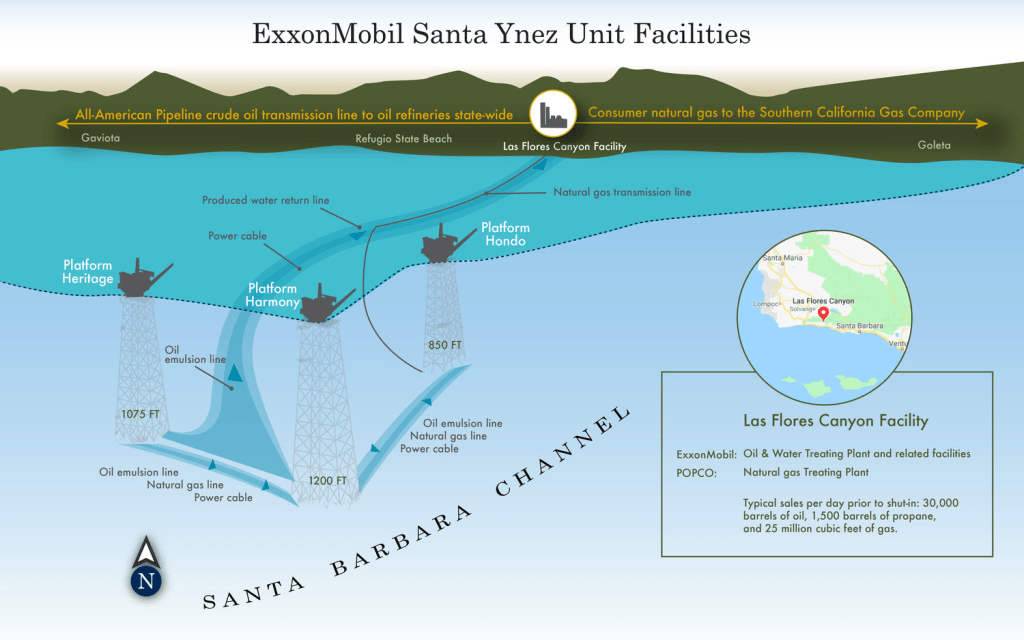

- Sable needs to raise significantly more money: According to leaked audio of Sable’s CEO briefing for select investors, the company will require $2.3 billion to achieve commercial production of oil and gas from its three platforms off the coast of Santa Barbara.

- That includes at least $900 million to buy out Exxon, to which Sable must pay 15% interest on debt due by March 31, 2027. By then, the loan would be about $1.1 billion, accruing $200 million in added debt.

- One of Sable’s only known assets other than the oil and gas project is a private plane the company purchased from its CEO, Jim Flores. The plane recently flew round-trip from Houston, where Flores lives, to Louisiana, in time for a football game at the CEO’s alma mater.

Comments from Santa Barbara County Supervisor Steve Lavagnino, an oil industry supporter, that explain his opposition to the transfer of Exxon’s pipeline permit to Sable:

“The final straw for me was a Hunterbrook article, which was as disturbing as anything I’ve read. I have many friends in the oil industry and I will continue to support efforts to access our natural resources, but it has to be done responsibly by operators who put safety above profits.”

Sable’s limited response to the Hunterbrook report includes information on decommissioning financial assurance:

- Sable’s original SYU Purchase and Sales Agreement (PSA) with Exxon required Sable to post a $350 million decommissioning bond “150 days following the resumption of production from the wells.”

- According to Sable, production resumed on May 15, 2025. The bond would have thus been required in October. (SYU production was halted by court order on June 6, so that “resumption date” may be irrelevant. Regardless, the Oct. financial assurance deadline is immaterial given the recent update to the PSA.)

- The PSA update extended the date for posting the decommissioning bond to three business days following the new Exxon Loan Maturity Date of March 31, 2027 or 90 days after first sales of hydrocarbons, whichever comes first. (Note the change in language from “resumption of production” to “first sales.” Brief well test production does not trigger posting of the decommissioning bond.)

- Under certain circumstances after the bonding is in place Exxon may seek an increase in the bonding amount to $500 million.

The decommissioning obligations are moot if Sable runs out of funds or is unable to resume SYU production prior to the 3/31/2027 PSA deadline. Exxon would remain fully responsible for SYU decommissioning.

Is it time for a public statement from Exxon on the SYU and Sable?