“Most investors see Chevron and Hess emerging as victors in the case, Goldman analyst Neil Mehta said in an interview.”

This is consistent with the opinion previously expressed on this blog. How does a partner in a single Hess asset prevent Chevron from acquiring the entire company?

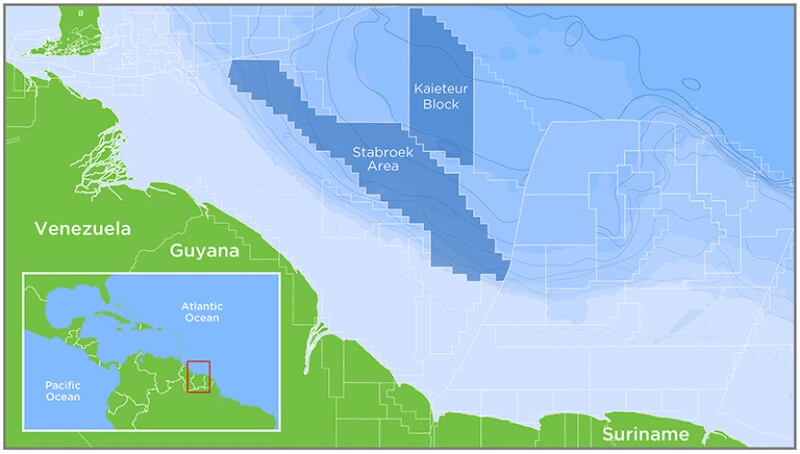

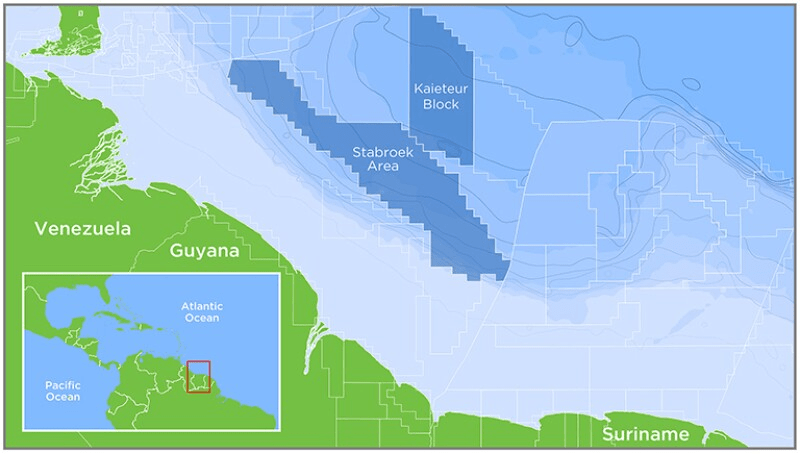

Chevron is not buying the Stabroek share; they are buying the company that holds that share. Hess is to be part of Chevron and there would be no change of control from the standpoint of the partnership.

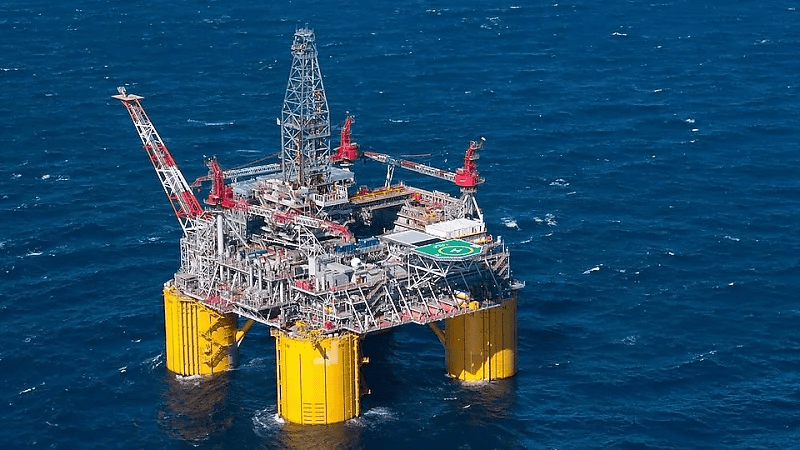

As an offshore operator, Exxon has been highly responsible from a safety standpoint. However, the company is not reluctant to stretch the envelope when it comes to contract rights. The most recent example was their acquisition of 163 GoM oil and gas leases for carbon disposal purposes, contrary to the terms of the sale notice and lease contracts.

Interestingly, Exxon’s partner in this dispute is state-owned China National Offshore Oil Corporation. CNOOC acquired their 25% Stabroek share when they purchased Nexen, a Canadian company (sound familiar?). Both the Canadian and US governments had reservations about this acquisition and nearly nixed the deal. Would either government bless that acquisition today?

An International Chamber of Commerce arbitration panel will hear the Stabroek case in May 2025, and the final decision is expected by September 2025.