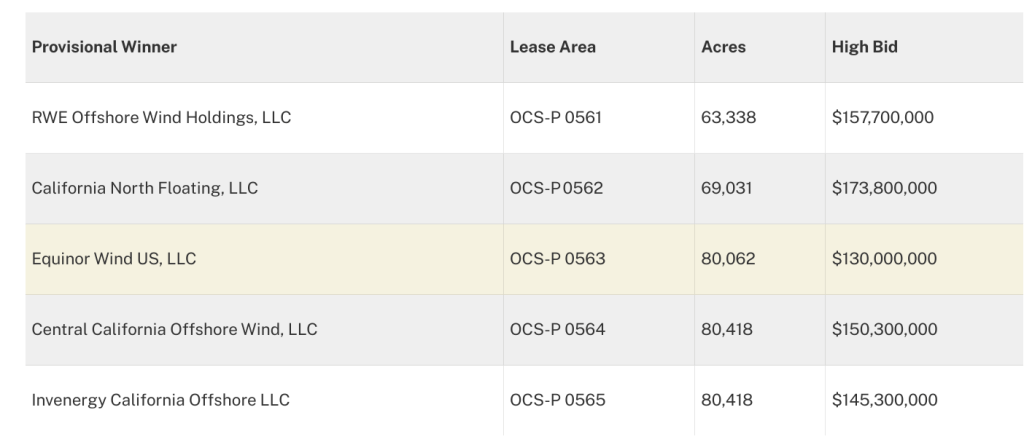

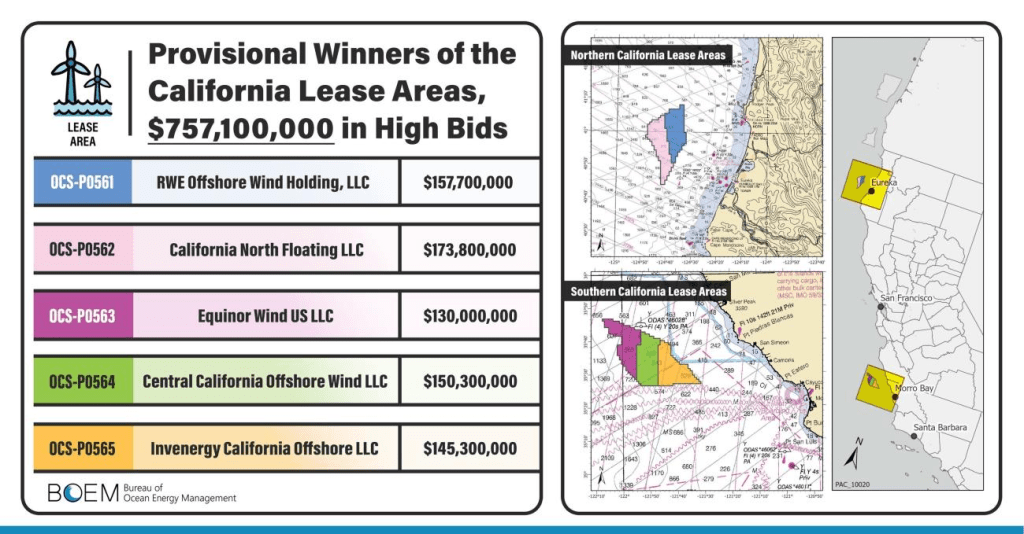

Only Equinor is a familiar name to the offshore oil and gas industry, so here are some blurbs about the other high bidders.

California North Floating, LLC, is a subsidiary of Copenhagen Infrastructure Partners (CIP). Since entering the US offshore market in 2016, CIP has built a leading offshore wind position through its affiliate Vineyard Offshore. This includes Vineyard Wind 1, the country’s first commercial scale offshore wind project which is currently under construction, as well as two lease areas under development totaling approximately 5.0 GW off the coast of Massachusetts and New York.

Central California Offshore Wind is managed by an East Coast offshore wind energy company, Ocean Winds North America LLC, which formed a joint venture with the Canada Pension Plan Investment Board to win the lease. Ocean Winds has more than 10 years of experience in floating offshore wind, most notably through the development and operation of Windfloat Atlantic (offshore Portugal), the world’s first fully commercially operational floating offshore wind farm

Equinor, a Norwegian company, is a major international oil and gas producer, an important wind energy investor, and a leader in the development of floating wind turbine technology. Equinor operates the Hywind Tampen floating offshore wind farm which will supply power to Norwegian offshore oil and gas fields.

Invenergy and its affiliated companies develop, own, and operate large-scale renewable and other clean energy generation and storage facilities in the Americas, Europe and Asia. Invenergy’s home office is located in Chicago, and it has regional development offices in the United States, Canada, Mexico, Spain, Japan, Poland, and Scotland.

RWE Renewables has experience covering the offshore and onshore wind energy value chain from development to construction and operation. These activities are the responsibility of two functional units, “Unit Renewables Europe & Australia” and “Unit Offshore Wind”, as well as the subsidiary RWE Renewables Americas. RWE Renewables also invests in large-scale solar projects and supports power producers, plant operators and other stakeholders in the development, construction and operation of photovoltaic and solar energy plants as well as in the construction of battery storage systems. The focus is on large-scale industrial projects.