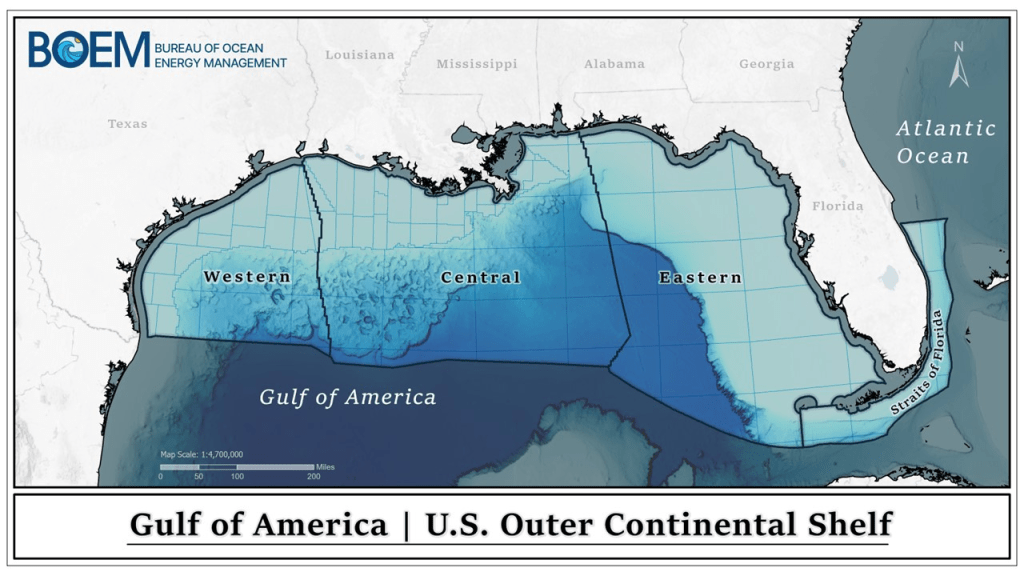

“The Bureau of Ocean Energy Management’s analysis reveals an additional 1.30 billion barrels of oil equivalent since 2021, bringing the total reserve estimate to 7.04 billion barrels of oil equivalent. This includes 5.77 billion barrels of oil and 7.15 trillion cubic feet of natural gas—a 22.6% increase in remaining recoverable reserves.”

| Year | Number of fields | Original Reserves | Historical Cumulative Production | Reserves | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Oil Bbbl | Gas Tcf | BOE Bbbl | Oil Bbbl | Gas Tcf | BOE Bbbl | Oil Bbbl | Gas Tcf | BOE Bbbl | ||

| 1975 | 255 | 6.61 | 59.9 | 17.3 | 3.82 | 27.2 | 8.66 | 2.79 | 32.7 | 8.61 |

| 1980 | 435 | 8.04 | 88.9 | 23.9 | 4.99 | 48.7 | 13.66 | 3.05 | 40.2 | 10.20 |

| 1985 | 575 | 10.63 | 116.7 | 31.4 | 6.58 | 71.1 | 19.23 | 4.05 | 45.6 | 12.16 |

| 1990 | 782 | 10.64 | 129.9 | 33.8 | 8.11 | 93.8 | 24.80 | 2.53 | 36.1 | 8.95 |

| 1995 | 899 | 12.01 | 144.9 | 37.8 | 9.68 | 117.4 | 30.57 | 2.33 | 27.5 | 7.22 |

| 2000 | 1,050 | 14.93 | 167.3 | 44.7 | 11.93 | 142.7 | 37.32 | 3.00 | 24.6 | 7.38 |

| 2005 | 1,196 | 19.80 | 181.8 | 52.2 | 14.61 | 163.9 | 43.77 | 5.19 | 17.9 | 8.38 |

| 2010 | 1,282 | 21.50 | 191.1 | 55.5 | 17.11 | 179.3 | 49.01 | 4.39 | 11.8 | 6.49 |

| 2015 | 1,312 | 23.06 | 193.8 | 57.6 | 19.58 | 186.5 | 52.78 | 3.48 | 7.3 | 4.78 |

| 2016 | 1,315 | 23.73 | 194.6 | 58.4 | 20.16 | 187.5 | 53.58 | 3.57 | 6.8 | 4.79 |

| 2017 | 1,319 | 24.65 | 195.2 | 59.7 | 20.78 | 188.9 | 54.21 | 3.87 | 6.3 | 5.00 |

| 2018 | 1,319 | 24.86 | 195.5 | 59.7 | 21.42 | 189.8 | 55.21 | 3.44 | 5.7 | 4.45 |

| 2019 | 1,325 | 26.77 | 197.0 | 61.8 | 22.12 | 190.9 | 56.09 | 4.65 | 6.1 | 5.74 |

| 2023 | 1,336 | 30.43 | 201.2 | 66.2 | 24.66 | 194.0 | 59.19 | 5.77 | 7.2 | 7.04 |

This increase in reserves will not please those responsible for the current 5 Year Oil and Gas Leasing Plan. They told us that we don’t need more OCS lease sales and that our biggest concern is producing too much oil and gas for too long!

The long-term nature of OCS oil and gas development, such that production on a lease may not begin for a decade or more after lease issuance and can continue for decades, makes consideration of net-zero pathways relevant to the Secretary’s determinations on how the National OCS Program best meets the Nation’s energy needs.“

Energy experts like Dan Yergin and Vicki Hollub have a much different view. Per Hollub:

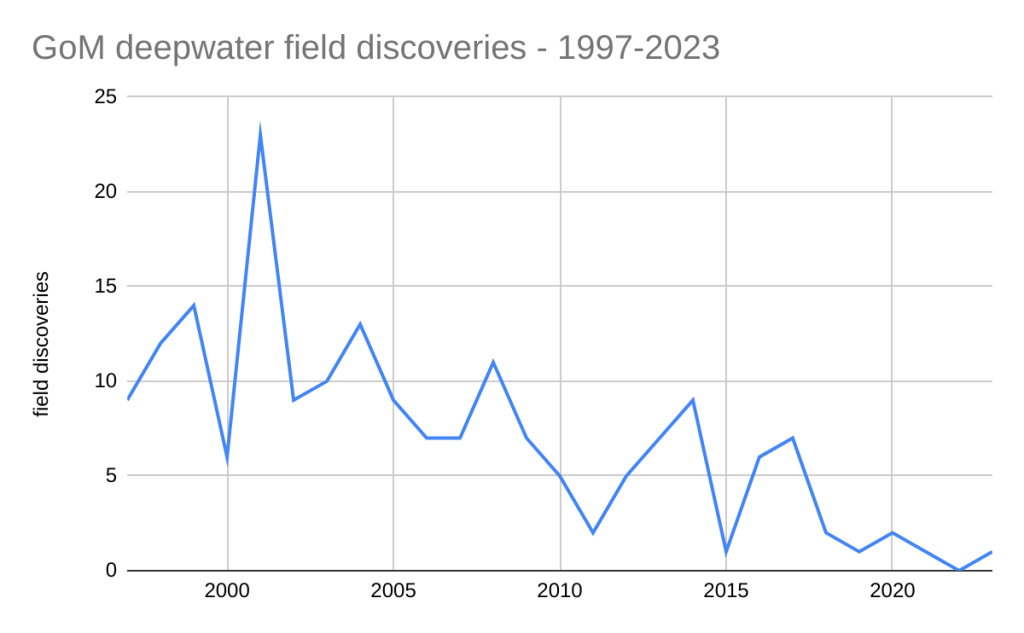

“Crude reserves are being found and developed at a much slower pace than they’ve been in the past. Specifically, she said the world has only newly identified less than half the amount of crude it’s consumed over the course of the past 10 years. Given the current trends, this means demand will exceed supply before the end of 2025.“

A bit off-topic, but Jeff Walker, a former colleague and the MMS Regional Supervisor in Alaska, had the best quip about reserve numbers. In explaining an operator’s revised reserve numbers for a producing unit which had leases with different royalty rates, Jeff noted that “oil always migrates to the lower royalty leases.”😉