Following an alleged missile strike on three platforms operated by the Crimea-based oil and gas company Chernomorneftegaz, satellite images indicate the fire is still visible at the site in the Black Sea. Russian official claims that the strike left behind several injured and missing persons.

offshore-energy.biz

Posts Tagged ‘Russia’

Alleged missile attack on Black Sea platforms

Posted in Offshore Energy - General, Russia, tagged Black Sea platforms, Crimea, missile attack, Russia, Ukraine on June 23, 2022| Leave a Comment »

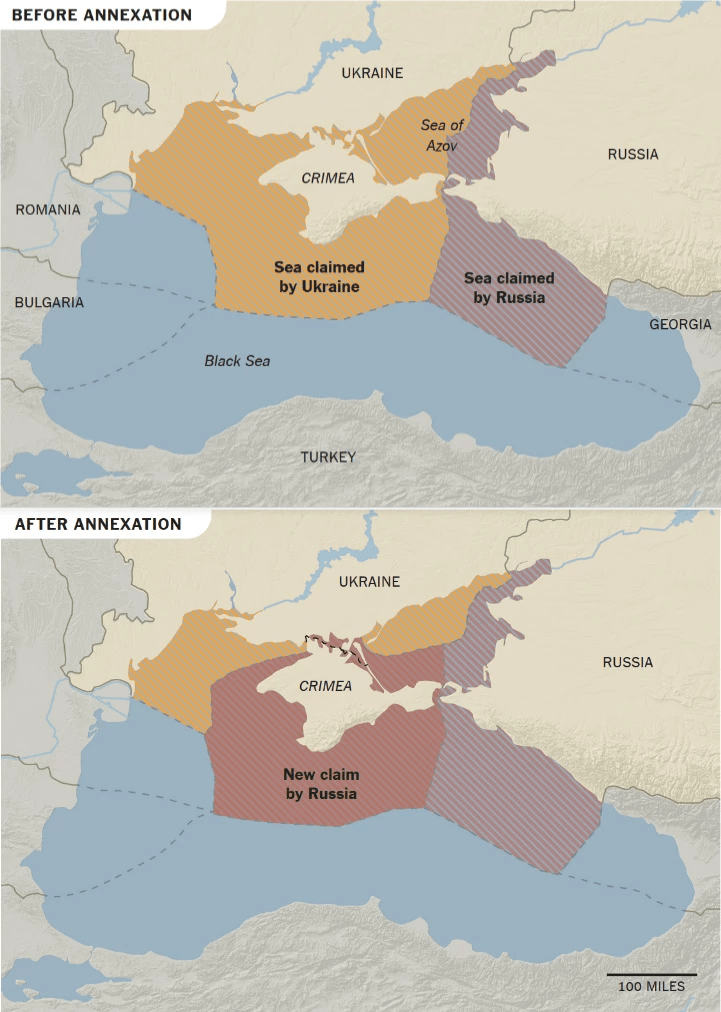

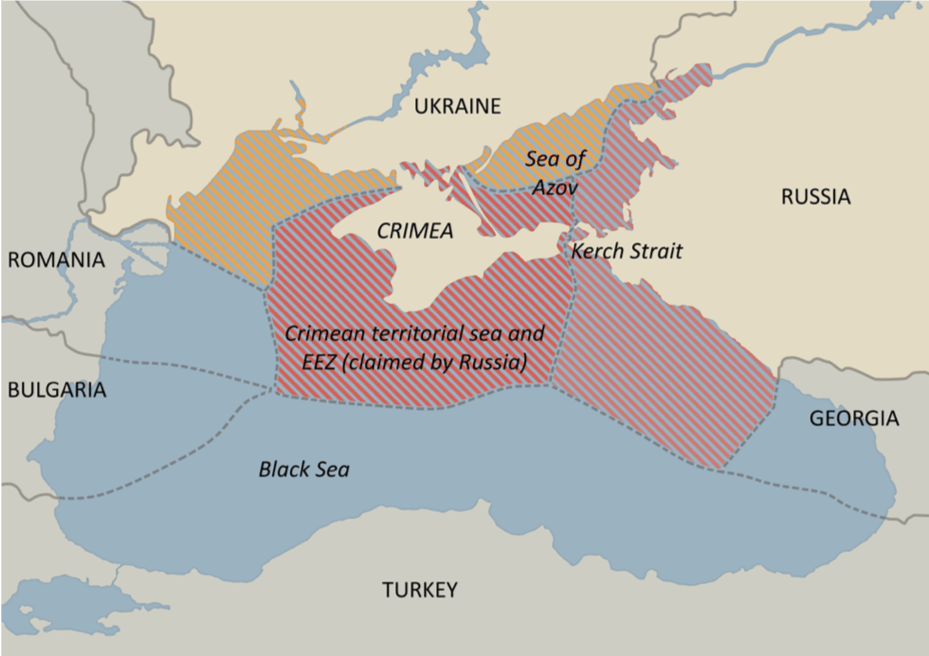

Let’s not forget the Black Sea resources seized by Russia following the Crimea annexation and their importance to Ukraine!

Posted in energy policy, Offshore Energy - General, Russia, tagged Black Sea, Crimea, Russia, Ukraine oil and gas on March 17, 2022| Leave a Comment »

Per our previous post on this topic, the Ukranian shelf may contain more than 70 Tcf of natural gas, most of which was seized by Russia along with Crimea. This illegal seizure of resources in 2014 should be considered as part of any long-term settlement and before easing sanctions on Russia.

For those who want to learn more, this 2018 article by Ukranian journalist Kostiantyn Yanchenko has proven to be particularly insightful. A few key points:

…when in 2014, two-thirds of the former Ukrainian water area passed to Russia with the occupation of Crimea, only a few experts assumed that the struggle for control over energy resources might have been among the main reasons for annexation. Against the background of Moscow’s famous explanation “Why Crimea? Be[cause]Kosovo!”, this version looked unconvincing, but there are many reasons to give it a second glance.

The naysayers often argue that Russia doesn’t have the technology to extract gas on the deep-water shelf. This is true, at least now. However, as researchers note, Russia’s short-term objective was not to benefit from the Black Sea gas but to block its production by the Western companies and hence secure its own positions in the European market.

Furthermore, Russia largely relies on an energy leverage in international relations. Thus, “The Energy Strategy of Russian Federation Until 2020” starts with the statement: “Russia has significant reserves of energy resources and a powerful fuel and energy complex, which is the basis for economic development, an instrument for domestic and foreign policy.”

Bad litigation, worse timing. China and Russia’s most effective allies?

Posted in climate, energy policy, Russia, Uncategorized, tagged China, climate litigation, Russia, Shell on March 15, 2022| Leave a Comment »

This is what major oil companies are up against. Meanwhile China expands coal production and consumption without having to worry about groups like this.

ClientEarth, a Shell shareholder, notified the energy major on Monday that it would commence legal proceedings against the company’s 13 executive and non-executive directors for what it said was the board’s failure to adopt a strategy that “truly aligns” with the 2015 Paris climate agreement. The not-for-profit group, which has a strong record of winning climate-related cases, wrote to Shell in advance of petitioning the High Court of England and Wales for permission to bring the claim.

Financial Times

Most of Ukraine’s Black Sea oil and gas resources were seized by Russia in 2014

Posted in Offshore Energy - General, Russia, tagged Black Sea, Crimea, Russia, Ukraine oil and gas on March 8, 2022| Leave a Comment »

These blurbs from the Atlantic Council and Middle East Institute give you a pretty good overview. No one should be terribly surprised by what is happening now.

The exact volumes of gas currently lying deep underneath the Black Sea are not yet known. Rough estimates predict that the Ukrainian shelf may contain more than two trillion cubic meters of gas. The exact figure is yet to be determined since two-thirds of the country’s maritime area passed to de facto Russian control following Moscow’s illegal annexation of Crimea in 2014. Ukraine’s state energy company Naftogaz is preparing to explore 32 remaining blocks.

Atlantic Council 3/30/2021

Ukraine’s chances for energy autonomy were effectively cancelled with Crimea’s illegal annexation. According to its Energy Ministry, Ukraine lost 80 percent of its Black Sea oil and gas deposits as a result. As of March 2014, the Crimean-based Chornomornaftogaz’s gas estimates totaled 58.6 bcm in an EEZ three times the peninsula’s land mass and potentially worth trillions. Upon annexation, Russia seized all its fields and production facilities; the U.S. imposed sanctions not long after. ExxonMobil withdrew from Ukraine’s EEZ while other hydrocarbon supers similarly retracted.

MEI-12/14/2020

Disappointing NYT headline

Posted in energy policy, Guyana, Offshore Energy - General, Russia, tagged energy policy, NYT, oil production on Federal lands, Russia, Ukraine on March 4, 2022| 1 Comment »

U.S. Oil Industry Uses Ukraine Invasion to Push for More Drilling at Home

New York Times

Actually, it’s a case of the Ukraine invasion demonstrating the obvious – domestic production is critical to our economy and energy security. Europe and the US have had a wake-up call and responsible leaders now recognize the importance of secure supplies and the need to halt purchases from a tyrant.

The oil industry is doing just fine with $100+ per barrel oil. They will produce oil and gas where the opportunities present themselves: Guyana, Mexico, North Sea, Africa, Brazil, Canada, private lands in supportive US states, and elsewhere. The folly is US policy that unreasonably restricts exploration on Federal lands, including the Outer Continental Shelf. These restrictions penalize the owners of those lands, the people of the United States, not the oil industry and certainly not the Russian tyrant.

Half-step by Exxon?

Posted in energy policy, Gulf of Mexico, Offshore Energy - General, Russia, Uncategorized, tagged Exxon, Russia, Sakhalin on March 1, 2022| Leave a Comment »

BP, Equinor, and Shell are exiting Russia, but Exxon’s response seems to be something less. Per Upstream:

US supermajor ExxonMobil is scaling back its operations on its flagship offshore development project in Russia’s Sakhalin Island region in response to the fallout from the crisis in Ukraine, according to the Sakhalin Online news website.

A consortium source cited by the Russian website claimed that foreign managers have been told to leave the project for an initial period of one month.

Upstream

Exxon accepted the political risks associated with lucrative Russian production, and they now have a massive moral and public relations dilemma. Will they try to wait this crisis out or take more permanent actions?

It would be nice to see Exxon return to the Gulf of Mexico where they haven’t drilled a well since 2019. Currently, Exxon’s primary interest in the Gulf is for carbon sequestration purposes. Perhaps they can focus more on the Gulf’s still promising production potential and less on its potential as a disposal site.

Update: Shell joins the exodus from Russia

Posted in energy, energy policy, Offshore Energy - General, Russia, tagged NordStream, Russia, Sakhalin, Shell on February 28, 2022| Leave a Comment »

The Board of Shell plc (“Shell”) today announced its intention to exit its joint ventures with Gazprom and related entities, including its 27.5 percent stake in the Sakhalin-II liquefied natural gas facility, its 50 percent stake in the Salym Petroleum Development and the Gydan energy venture. Shell also intends to end its involvement in the Nord Stream 2 pipeline project.

Shell.com

Norway says adios to Russia. Ditto BP. Is Exxon (Sakhalin) next? Shell?

Posted in energy policy, Norway, UK, Uncategorized, tagged bp, Equinor, Norway, Russia, UK on February 28, 2022| Leave a Comment »

On Sunday, the Norwegian government announced that its sovereign wealth fund, the world’s largest, wwould divest its Russian assets, worth around 25 billion Norwegian crowns ($2.80 billion).

Reuters

“In the current situation, we regard our position as untenable,” Equinor Chief Executive Anders Opedal said in a statement. “We will now stop new investments into our Russian business, and we will start the process of exiting our joint ventures in a manner that is consistent with our values.”

Reuters

British oil giant BP said Sunday that it is “exiting” its $14 billion stake in Russian oil giant Rosneft over Moscow’s invasion of Ukraine in one of the biggest signs yet that the Western business world is cutting ties over the Kremlin’s invasion of Ukraine.

Washington Post

Sanctions on Russian energy not a simple matter

Posted in energy, energy policy, Offshore Energy - General, tagged European energy crisis, Russia, sanctions on February 22, 2022| Leave a Comment »

From an excellent FT article:

BP owns almost a fifth of Russia’s largest oil producer Rosneft. UK-listed rival Shell controls 27.5 per cent of Gazprom’s huge Sakhalin-2 offshore gas project in Russia’s far east. Exxon has been operating in Russia for 25 years and producing oil and gas in eastern Russia since 2005 in a partnership involving two Rosneft affiliates.

Financial Times

More than 20 European countries import gas from Russia. The Czech Republic and Latvia import 100% of their gas from Russia. Hungary, Slovakia, Bulgaria, Finland, Germany, and Poland import more than half of their gas from Russia.

Clumsy sanctions could send oil and gas prices soaring to Russia’s benefit and the West’s detriment. We should first remove the sanctions that have intentionally and inadvertently been imposed on our own producers, including leasing blockades and permitting obstacles. The Ukraine crisis and its side effects will be with us for years, as will the demand for oil and gas. We need both immediate and longer term supply solutions.