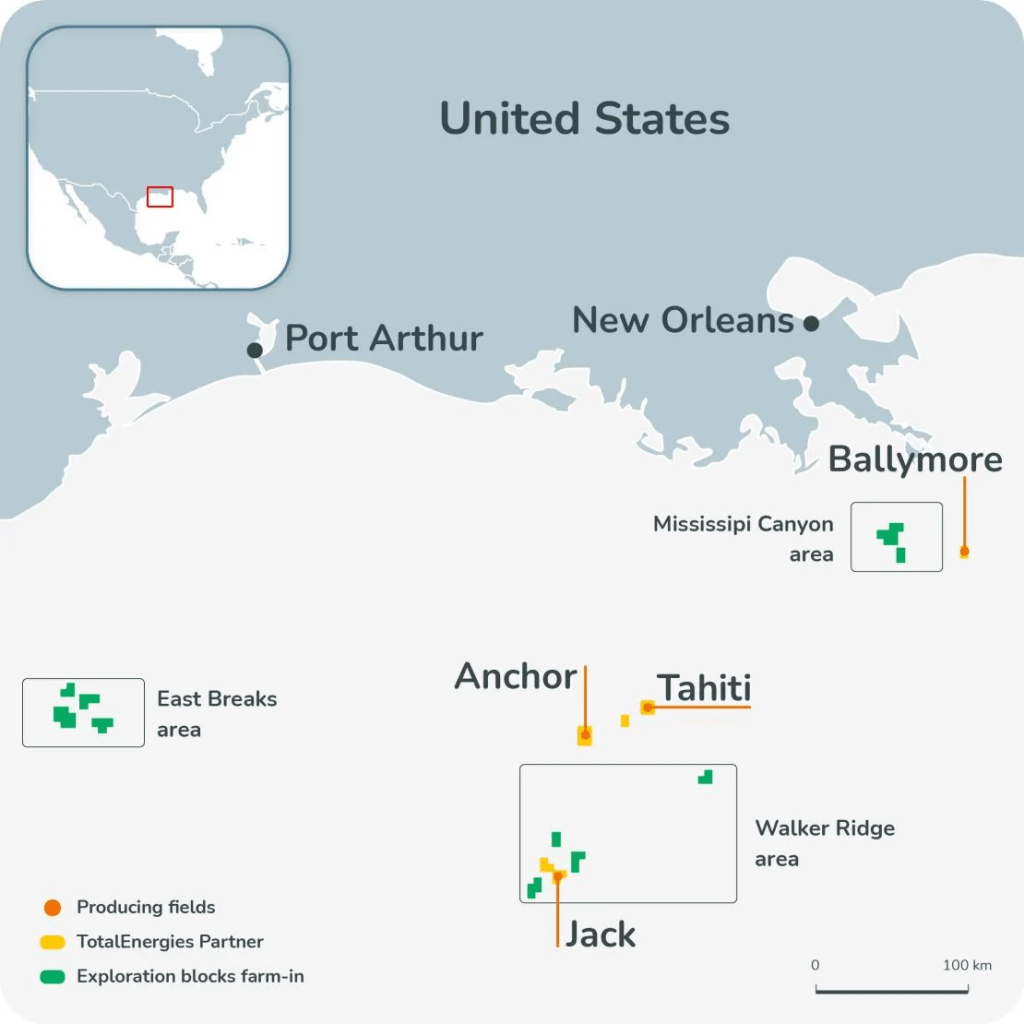

This week Total announced the acquisition of a 25% working interest in 40 Chevron leases in the Gulf of America. Total already owned interest in Chevron’s producing Ballymore (40%), Anchor (37.14%), Jack (25%), and Tahiti (17%) fields. Ironically, Federal regulations prohibited Total from jointly bidding with Chevron for any of those leases at the time of the sales. How does that make sense?

Restrictions limiting joint bidding by major oil companies date back to the Energy Policy and Conservation Act of 1975. Although these restrictions were intended to increase competition and revenues, OCS program economists have asserted, and studies have shown, that the ban results in fewer bids per tract and lower bonuses to the government.

Total did not submit a single bid in any of the past 4 Gulf of America lease sales. Perhaps they prefer to acquire interest in blocks previously leased to companies like Chevron. That is a reasonable acquisition strategy. However, farm-in acquisitions yield no bonus dollars to the Federal government. Wouldn’t it have been in the government’s best interest if some of those acquisition dollars were spent at lease sales where the bonus bids go to the US Treasury? It’s long past time to remove the joint bidding restrictions!