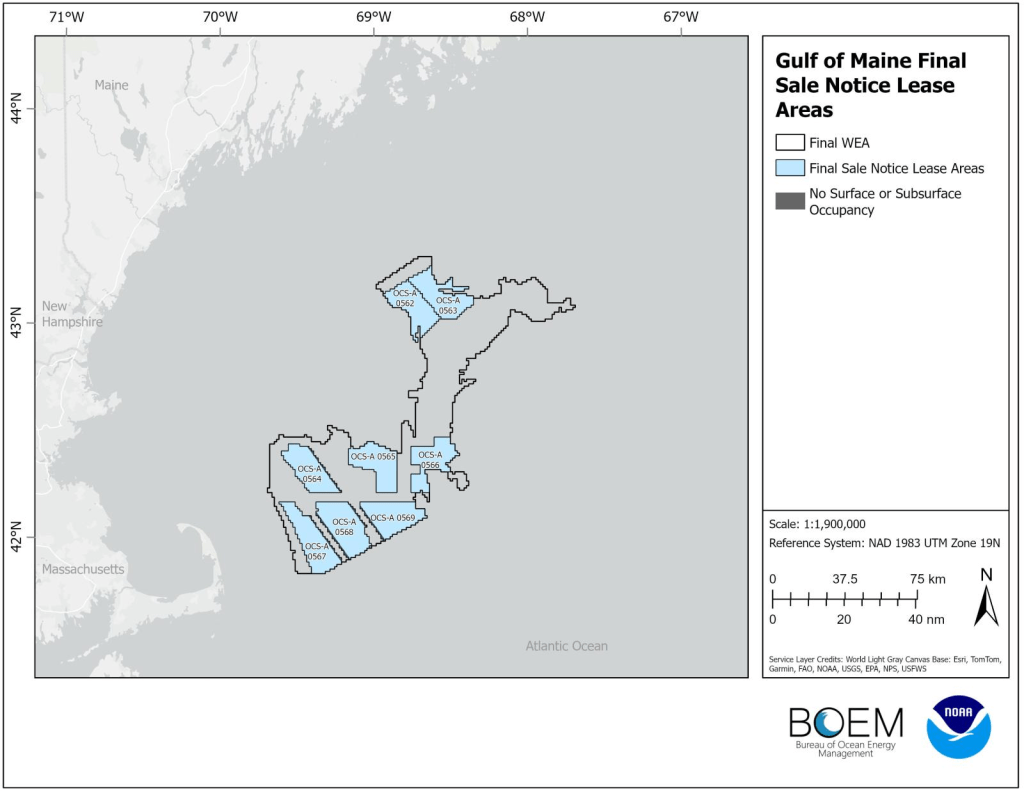

Gulf of Maine Final Lease Areas, Acres, and Assigned Region

| Lease Area ID | Total Acres | Developable Acres |

| OCS-A 0562 | 97,854 | 97,854 |

| OCS-A 0563 | 105,682 | 105,682 |

| OCS-A 0564 | 98,565 | 93,756 |

| OCS-A 0565 | 103,191 | 103,191 |

| OCS-A 0566 | 96,075 | 96,075 |

| OCS-A 0567 | 117,780 | 113,208 |

| OCS-A 0568 | 124,897 | 116,363 |

| OCS-A 0569 | 106,038 | 101,757 |

| Total | 850,082 | 827,886 |

| Average | 106,260 | 103,486 |

Today’s Gulf of Maine sale will likely be the last wind lease sale for at least a year.

Per a provision in the “Inflation Reduction Act,” no offshore wind leases may be issued after 12/20/2024, the one year anniversary of the last oil and gas lease sale (no. 261).

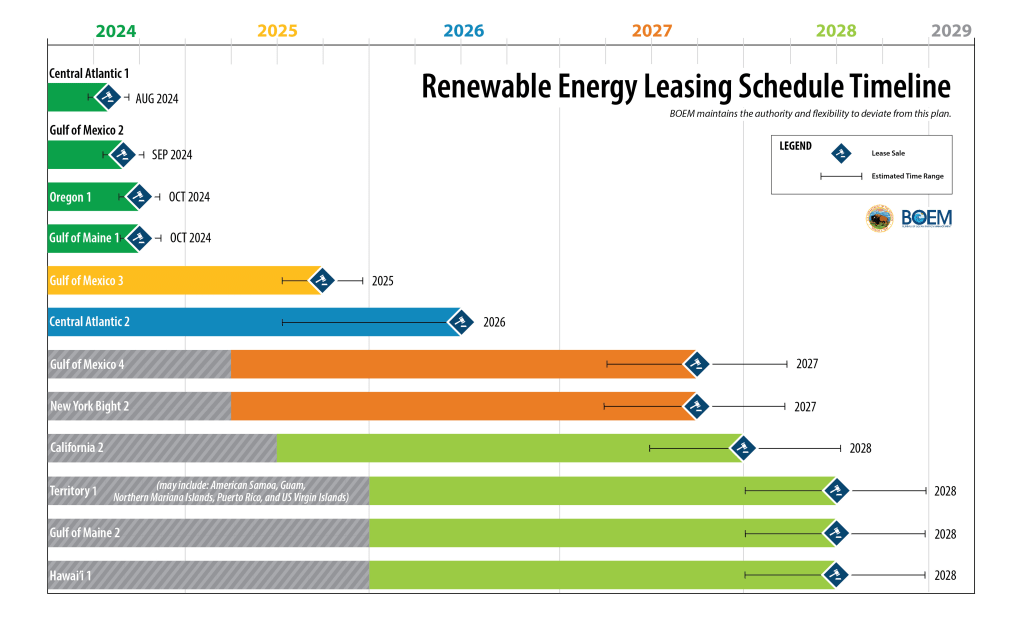

Perhaps as a result of the legislative restriction, their desire to maximize wind leasing, and their plan to hold the fewest oil and gas lease sales in the history of the OCS program, BOEM front-loaded the 5 year wind leasing plan to include 4 sales from Aug. – Sept. 2024 (see schedule below). However, contrary to plan, the Gulf of Mexico sale was cancelled for lack of interest and the Oregon sale was cancelled at the request of the Governor in response to tribal and coastal county opposition.

The date of the next oil and gas lease sale is anyone’s guess. Next week’s elections are, of course, the elephant in the room. However, there is also an enormous ruling by a Federal judge in Maryland that would halt the issuance of Gulf of Mexico oil and gas leases and the approval of operating plans effective Dec. 20, 2024. Ironically (or perhaps not?), this is the same date after which no wind leases may be issued absent an oil and gas lease sale.

Chevron and industry trade associations have appealed Judge Boardman’s ruling. (Given the enormous implications of that ruling on current and future Gulf of Mexico production, I’m curious as to why Chevron is the only major producer that is a party in this appeal. Chevron was also the only producer that was a party in the litigation overturning the restrictive Sale 261 lease sale provisions. I’m assuming there is some legal or tactical reason for the absence of participation by Shell, bp, and Oxy?)

Finally, given the legislation linking future wind sales with oil and gas sales, are the Sierra Club et al, the plaintiffs in this case, comfortable with Judge Boardman’s decision? Perhaps they are okay with the judge’s ruling given the absence of any planned Atlantic wind leasing until 2026?